24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

As the world's largest power lithium battery manufacturer, the relationship between CATL and automotive companies has always been delicate.

According to SNER Research data, from January to September 2022, the global total power lithium battery loading volume reached 341.3 GWh, up 75.2% year on year. In September, the global total electric vehicle battery loading volume was 54.7 GWh, while CATL's power lithium battery loading volume was 19.9 GWh, ranking first in the world.

It is not difficult to calculate that CATL's lithium battery load accounted for 36.38% of the global total in September. CATL is a well-deserved leader in the electric vehicle battery industry.

Zeng Yuqun, Chairman of CATL, also stated at the 2022 World Power Lithium Battery Conference that in every three electric vehicles in the world, there is a battery equipped with CATL. There is no exaggeration in this statement, and it is even conservative based on September data.

CATL supplies power lithium batteries to car companies, and car companies bring a steady stream of orders to CATL. The two seem to be in harmony, but in reality, the tide is surging.

In recent years, the price of power lithium batteries has been rising continuously, and automotive companies have complained about this. Recently, Zhu Huarong, Chairman of Chang'an Automobile, stated that the lack of core and expensive electricity has seriously damaged the production order of the automotive industry. This is tantamount to adding frost to the snow for automotive companies that have been unable to increase their gross profit margin on a single vehicle.

There are not a few automotive companies with this idea. As early as at the 2022 Global Lithium Power Battery Conference, Zeng Qinghong, Chairman of GAC Group, stated that the cost of lithium power batteries has accounted for 40% or even 60% of new energy vehicles. The more new energy vehicles are sold, the more CATL earns, and automotive companies are simply working for CATL.

As soon as this statement was made, CATL immediately became the target of public criticism, and the issues that car companies and CATL knew well were finally put on the table.

Although other automotive companies have not openly paired up with CATL, they have also been carrying out a de Ninghua layout in the field of lithium battery power for new energy vehicles.

An encirclement and suppression campaign against CATL has officially begun. In other words, today's CATL has fallen into a critical situation.

01. Biggest competitor BYD

In 2022, CATL will remain the global leader in the field of electric vehicle batteries.

According to data, from January to October 2022, CATL ranked first among China's power lithium battery installed companies with 106.78 GWh of data, accounting for 47.62% of the overall installed capacity. Its power lithium battery installed capacity from January to October was approximately twice that of BYD, which ranked second.

Far ahead of the second place, it seems that Ning Wang deserves the title, but this year's situation seems to be somewhat different.

The data seems promising, but after careful analysis, it is not. It should be understood that from 2019 to 2021, the market share of CATL's battery installed capacity exceeded 50%, but in January to October 2022, the market share of CATL's battery installed capacity was only 47.62%, and in 8 of 10 months, the market share was below 50%.

This means that in the next November and December, if CATL's installed capacity does not significantly increase, this year may become the first time that CATL has experienced an annual installed capacity market share of less than 50% since 2019. That is to say, this year, Ning Wang is likely to take the first step towards falling from the altar.

An important reason for this result is the rapid rise of other power lithium battery manufacturers. Take BYD, which ranks second. Since 2020, BYD has been steadily advancing in the power lithium battery field. In 2020, BYD's market share of power lithium battery installed capacity was only 14.9%, but by 2022, its market share of power lithium battery installed capacity from January to October had reached 22.66%.

This means that in the big test for lithium batteries powered by new energy vehicles, the gap between the second place and is constantly narrowing.

The significant increase in the installed capacity of BYD's power lithium batteries is closely related to the surge in sales of BYD vehicles. From January to October 2022, BYD's cumulative sales of new energy vehicles were 1397870, up 233.92%. Among them, the cumulative sales of new energy passenger vehicles were 1392839, up 239.05%. In September and October 2022, BYD's sales successively exceeded 200000, winning the sales champion of domestic new energy vehicles.

BYD's power lithium-ion batteries enable its new energy vehicles, and through its sales of new energy vehicles to drive orders for power lithium-ion batteries, a complete set of closed loops has been formed. The characteristics of its own supply have also become the difference between BYD and CATL.

In addition to self supplied orders, the popularity of other automotive companies cannot be ignored. Wang Chuanfu, the founder of BYD, once said, "Almost every automotive brand you can think of is negotiating cooperation with Ford batteries.". In the future, blade batteries will be successively installed on new energy vehicles of various mainstream brands at home and abroad.

BYD's lithium-ion battery has begun to be supplied externally, and Ning Wang is no longer the only option.

02. The besieged King Ning

On July 22nd, Wu Kai, the chief scientist of CATL, stated at the power lithium battery conference that although our company has not lost money this year, it is basically struggling on the edge of slightly profitable, and it is very painful. You can also imagine where profits are going.

What Wu Kai said is not a lie. In the first quarter of 2022, CATL's total revenue was 48.678 billion yuan, up 153.97% year-on-year. However, its net profit attributable to the parent company was only 1.493 billion yuan, down 23.62% year-on-year. Moreover, its overall gross profit margin was only 14.48%, far from the previous gross profit margin of often exceeding 20%.

In response, Ning Wang has repeatedly stated that it is due to the rising prices of raw materials upstream of power lithium batteries. In recent years, the price of lithium carbonate has continuously skyrocketed, with a speed comparable to that of automotive chips in 2021. It is understood that the price of lithium carbonate was about 50000 yuan per ton at the beginning of 2021, and by the first quarter of 2022, its price had skyrocketed to about 500000 yuan per ton.

The sharp rise in the prices of upstream raw materials has brought enormous cost pressure to CATL. In order to alleviate the cost pressure, CATL has chosen to pass on cost pressure to the downstream through price increases, while in the downstream of power lithium batteries, it is the car companies that are in the midst of a shortage of cores.

As for car companies, the lack of cores has not yet passed, and they have ushered in expensive electricity. The two are like two mountains, causing suffering for car companies with inherently low gross profit margins. According to Zhu Huarong, Chairman of Chang'an Automobile, the lack of cores and expensive electricity are two major problems faced by car companies, with expensive electricity leading to a new increase of 5000 to 35000 yuan in the cost of a single car.

On the chip side, various automotive companies have conducted various layouts to ensure future supply, and so has the power lithium battery side. Manufacturers such as China Innovation Airlines, Guoxuan High Technology, Xinwanda, Honeycomb Energy, and Yiwei Lithium Energy have all started to cooperate with automotive companies. Compared to CATL, automotive companies seem to be more willing to cooperate with non leading companies, or establish joint ventures, or acquire shares, or sign long-term orders, In order to seek two power supplies and three power supplies for lithium batteries for new energy vehicles.

Automobile companies have accelerated their layout, and multiple power lithium battery manufacturers have rapidly emerged. For example, China Innovation Airlines has been closely embracing GAC in recent years, Honeycomb Energy has received strong support from Great Wall Motors, and Xinwangda has received investment from companies such as Weixiaoli and GAC. Guoxuan Hi-Tech has teamed up with a series of strong companies such as SAIC General Motors Wuling, Jianghuai, Zero Run, and Chery to continue to make efforts in the field of power lithium batteries for new energy vehicles.

As early as 2012, CATL and BMW Group of Germany conducted strategic cooperation, achieving a rapid rise. Subsequently, CATL caught up with China's efforts to develop new energy vehicles. With years of accumulated technology and relevant experience, CATL quickly grew into a unicorn in the lithium battery industry for new energy vehicles, which was out of control.

At this moment, just like at that moment, it seems that second-tier power lithium battery manufacturers are rapidly rising, constantly eroding CATL's market share. In fact, it is still car companies that are giving second-tier power lithium battery manufacturers opportunities. The phenomenon of Ningwang's dominance has emerged as a trend to be broken.

In fact, in addition to the above car companies, CATL's Bole BMW Group is also splitting orders in CATL's hands. On September 9, 2022, BMW Group announced that it has awarded CATL and Yiwei Lithium Energy two partners with a contract worth more than 10 billion euros for the production and demand of electric cells.

CATL has obviously been caught in the ambush of car companies and power lithium battery manufacturers. Ning Wang, who has been deeply engaged in the power lithium battery field for several years, has also realized this problem, and a breakthrough belonging to CATL has already begun.

(Source: Network)

In the past two years, CATL has repeatedly dismissed employees and friends based on competition agreements, patent infringement, and other issues, and filed a lawsuit against Honeycomb Energy for unfair competition. Finally, Honeycomb Energy paid CATL a settlement payment of 5 million yuan.

In addition to signing a competition agreement, CATL has also reversed its layout of automotive companies and strengthened its binding with them to maintain its position. Currently, CATL has invested in multiple new forces such as Nezha Automobile, Aichi Automobile, Avita Technology, BAIC Blue Valley, and Geely Krypton Automobile. In terms of traditional automotive companies, they have been deeply bound through joint production, such as Time FAW, Time Geely, Time GAC, Time SAIC Dongfeng era, etc.

With years of accumulation and rapid counterattack by Ning Wang, it is obviously not easy for car companies to overthrow Ning Wang. However, under the conscious layout of car companies, how long can CATL's dominance last?

The war has already begun, and it is destined to be a long tug of war.

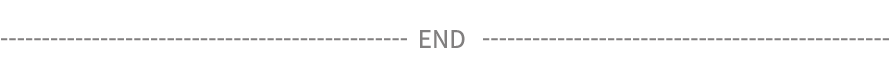

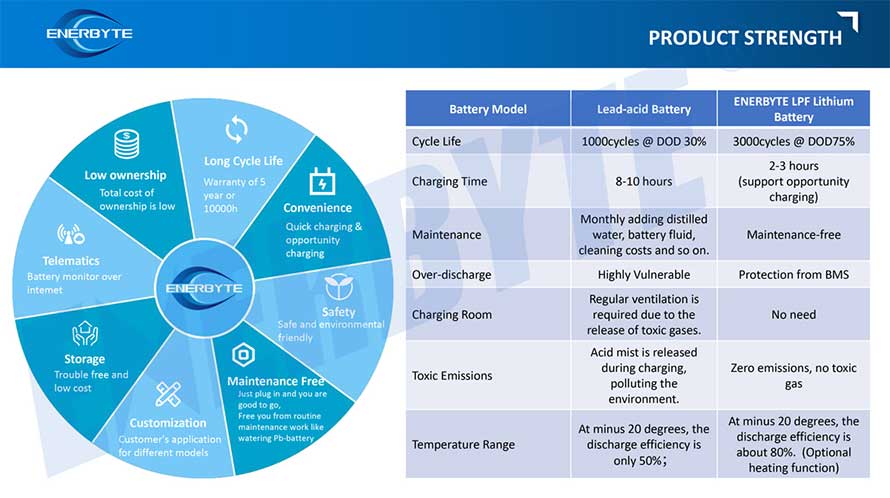

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

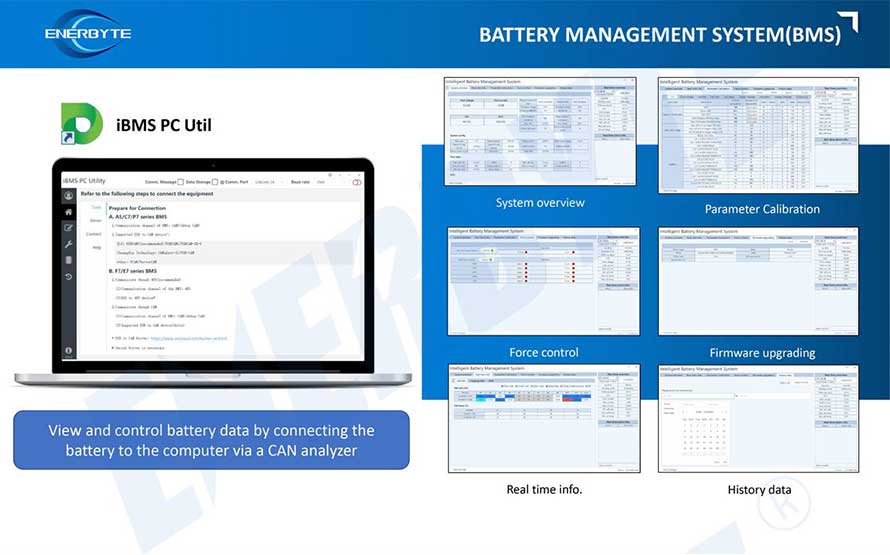

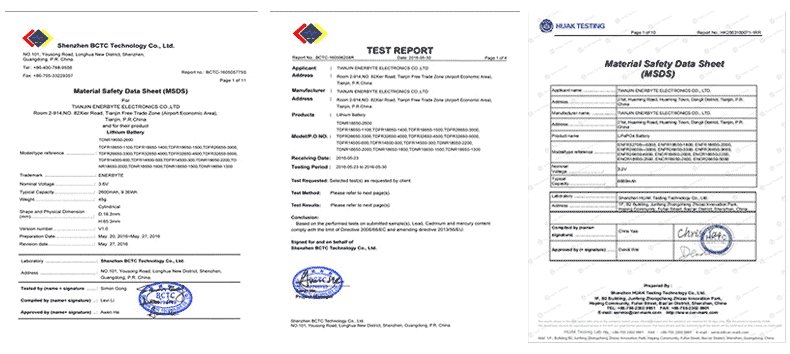

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline