24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Downstream demand and production schedules are relatively optimistic, driving up the consumption of lithium carbonate. Some downstream material factories have demands for purchasing to meet rigid needs or for inventory stocking. Upstream lithium salt factories still mainly hold the sentiment of maintaining prices. Considering the current cumulative inventory level of lithium carbonate, it is expected that the spot price of lithium carbonate will show fluctuations within a certain range.

On November 1st, the price of lithium carbonate increased slightly. The SMM battery-grade lithium carbonate index price was 73,805 yuan/ton, rising by 160 yuan/ton compared to the previous working day. The price of battery-grade lithium carbonate ranged from 72,300 to 75,400 yuan/ton, with an average price of 73,850 yuan/ton, increasing by 150 yuan/ton compared to the previous working day. The price of industrial-grade lithium carbonate ranged from 69,200 to 70,200 yuan/ton, with an average price of 69,700 yuan/ton, also rising by 150 yuan/ton compared to the previous working day.

The focus of the spot transaction price of lithium carbonate has rebounded slightly. Downstream demand and production schedules are relatively optimistic, driving up the consumption of lithium carbonate. Some downstream material factories have demands for purchasing to meet rigid needs or for inventory stocking. Upstream lithium salt factories still mainly hold the sentiment of maintaining prices. Considering the current cumulative inventory level of lithium carbonate, it is expected that the spot price of lithium carbonate will show fluctuations within a certain range.

Lithium Ore:

This week, the price of lithium salts has not changed much.

Regarding spodumene, the price of the lithium ore index decreased by 1 US dollar/ton compared to last week. Recently, due to the fluctuations in the price of lithium salts and the sentiment of maintaining prices on the supply side, the price of spodumene is at a relatively high level. Although the demand side has a strong willingness to purchase goods, with a certain amount of lithium ore inventory and a pessimistic expectation of a future decline in the price of salts, the willingness to conclude transactions is low, and there have been no large-batch transactions except for purchases to meet rigid needs.

On the lepidolite side, on the supply side, recently there have been no auctions by large lepidolite manufacturers. Some mining factories have quoted relatively low prices due to cost pressures and have a strong willingness to ship goods, but the quantity is limited. The quotations of other small and medium-sized mining factories are at relatively high levels for lithium salt factories. On the demand side, due to cost inversion, the acceptable quotations are relatively low, and the acceptance of the current quotations of mining factories is low. Therefore, there are more inquiries but fewer transactions in the market.

It is expected that the price of lithium salts will fluctuate within a certain range along with the price of lithium salts.

Lithium Carbonate:

This week, the spot price trend of lithium carbonate showed fluctuations within a certain range. Overall, the focus of the transaction price showed a slight upward trend. Downstream production schedules maintained the previously high production level. Some material factories have demands for purchasing to meet rigid needs or for a slight inventory stocking. Upstream lithium salt factories held a relatively strong sentiment of maintaining prices at the high point of annual demand, thus driving up the focus of the spot transaction price slightly this week. Considering the relatively optimistic production schedule expectations of the downstream in the future and combining with the cumulative inventory level of domestic lithium carbonate, it is expected that the spot price of lithium carbonate will still show fluctuations within a certain range.

Lithium Hydroxide:

This week, the price of lithium hydroxide continued its previous downward trend. In terms of production, most manufacturers produce according to orders, with little change from expectations. In terms of market sentiment, the supply side, due to cost reasons, continued to quote prices with a relatively high sentiment of maintaining prices. However, except for a small number of transactions in traditional industries, there were few single-piece purchases in the lithium battery industry. On the demand side, recently, due to the good sales volume of overseas ternary power terminals, it has been transmitted upward to the ternary material end, and some material factories have a slight increase in orders. However, overall, the demand still maintained its previous downward trend. Therefore, the overall demand for lithium hydroxide was not much different from expectations. Overall, the price of lithium hydroxide has no upward momentum and is expected to maintain its current low downward trend.

Electrolytic Cobalt:

This week, the price of electrolytic cobalt operated stably for the time being. From the supply side, the current overall operating rate maintained a relatively high level, and the social supply was sufficient. From the demand side, the downstream alloy and magnetic material directions maintained purchases to meet rigid needs and had no more willingness to stock up. From the overall market situation, due to the expected surplus in the market in the future, the spot price may be difficult to be supported under the game between supply and demand.

Intermediate Products:

This week, the price of cobalt intermediate products operated stably for the time being. From the supply side, the current port inventory was sufficient, and the spot supply was guaranteed. From the demand side, the downstream cobalt-based smelting factories had a large reduction in production, and the demand for purchases to meet rigid needs had decreased. Considering the overall market situation, since it is currently in the stage of annual long-term contract negotiation, the trading atmosphere in the overall spot market was cold, and the spot price remained stable. It is expected that in the future market, due to the guaranteed supply side and the expected surplus in the future, the spot price may still have a downward possibility.

Cobalt Salts (Cobalt Sulfate and Cobalt Chloride):

This week, the price of cobalt salts continued to decline. From the supply side, the overall supply volume of the market remained stable, but the operating rate was still at a relatively low level. From the demand side, the downstream ternary precursor enterprises had a low volume of single-piece purchases, and most of them only fulfilled long-term contracts. The purchasing willingness of the downstream cobalt tetroxide enterprises was also relatively weak, and the overall transaction volume was not high. Considering the supply and demand situation of the market, the demand in the spot market was still weak. Therefore, it is expected that the price may further decline next week.

Cobalt Salts (Cobalt Tetroxide):

This week, the price of cobalt tetroxide decreased slightly. From the supply side, the operating rate of the cobalt tetroxide smelting factory was relatively stable, and the overall supply volume changed little. From the demand side, the situation of market inquiries increased, and some enterprises had new orders, but the overall transaction volume was still relatively limited. It is expected that next week, due to the possible continued decline in the price of raw material cobalt salts, the cost support for cobalt tetroxide will weaken, and the spot price may further decline. However, due to the recent relatively active market, the expected decline in price will be relatively limited.

Ternary Precursors:

This week, the price of ternary precursors continued to decline due to the slight downward trend of raw material prices. As of Thursday this week, the consumption of 5-series ternary precursors decreased by 150 yuan/ton, the consumption of 6-series ternary precursors decreased by 240 yuan/ton, and the power of 8-series ternary precursors decreased by 320 yuan/ton. On the supply side, the production schedule situation of ternary precursor manufacturers remained basically stable compared to last week. On the demand side, the purchasing willingness of the domestic terminal market this week was slightly boosted, and the production schedule of ternary material factories was slightly increased. The overseas terminal demand was still sluggish, and it is expected that the export volume of ternary precursors will continue to decrease month by month in the future market.

Ternary Materials:

On the raw material side, this week the price of metal sulfates continued the downward trend of last week. Among them, the price of nickel sulfate decreased by 175 yuan/ton, the price of cobalt sulfate decreased by 250 yuan/ton, and the price of manganese sulfate decreased by 30 yuan/ton. Regarding lithium salts, the price of lithium carbonate increased slightly this week by 400 yuan/ton, while the price of lithium hydroxide continued to decline by 250 yuan/ton. This week, under the influence of the downward trend of raw material costs, the price of ternary materials continued to maintain a downward trend. Supported by the slight rebound of the price of lithium carbonate, the downward trend of the price of medium and low-nickel ternary materials was relatively small, while the downward trend of the price of high-nickel ternary materials was relatively large.

On the supply side, in October, the production schedules of some ternary material manufacturers showed a slight upward trend, but the production schedules of the leading manufacturers were still relatively stable. The overall production volume of ternary materials exceeded expectations, increasing slightly compared to September. On the demand side, the increment of ternary power battery cells was relatively small. The demand for consumer ternary battery cells maintained a relatively high level driven by the booming sales of electric tools and electric two-wheelers. However, since the proportion of consumer ternary battery cells in ternary battery cells was relatively small, the driving effect on the increase in the demand for ternary materials was limited.

Lithium Iron Phosphate:

This week, the market price of lithium iron phosphate did not fluctuate much. However, for some suppliers, the market in November is expected to experience significant changes. This is mainly because suppliers have been facing relatively low processing fees for a long time, making them cautious about new orders. However, actually about five suppliers have shown signs of order increment. When the increment reaches a certain level, the processing fee may increase slightly. The current market situation shows the sensitivity of the supply chain to changes in supply and demand, especially in the delicate balance between processing fees and order increments.

Lithium Phosphate:

Recently, both phosphoric acid and ammonium sulfate, the raw materials of lithium phosphate, have increased slightly in price. The demand for new energy has increased, and the maintenance of phosphorus chemical enterprises, as well as the time node of winter storage, have led to relatively low raw material inventories. Lithium phosphate enterprises also have the demand for order increment from some lithium iron phosphate enterprises, but they are often limited by production capacity and price, and it is difficult to increase production schedules. Although lithium phosphate enterprises have the intention to raise prices, it is difficult for the price to increase significantly. However, if the raw material price continues to increase, the demand for price increase of lithium phosphate enterprises will be stronger.

Lithium Cobaltate:

This week, the price of lithium cobaltate continued to decline. Currently, the main lithium cobaltate materials in the market are those with a voltage of 4.4V - 4.5V. The current demand maintains stable. The lithium cobaltate materials with a voltage of 4.5V and above have certain technical barriers, and only leading enterprises can mass-produce them. On the supply side, the production volume of lithium cobaltate in October decreased slightly. The CR5 was 88%, indicating a highly concentrated market. It is expected that the demand for lithium cobaltate will weaken after the downstream stocking cycle slows down in the future market, and the production volume will maintain a downward trend.

Negative Electrode:

This week, the price of negative electrode materials operated weakly. In terms of cost, the price adjustment policies of different refineries for low-sulfur petroleum coke are different, and the price is in a state of fluctuation. But with the subsequent market cooling down, it is expected to have a downward adjustment possibility in the future. The raw coke of oil-based needle coke is currently still relatively stable, but with the current release of some new production capacities, the supply increases, and there may be a risk of price decline for needle coke in the future. The outsourcing of graphitization is currently still extremely light in the market. At the same time, as the southwest region is about to enter the dry season, the electricity bill will be increased, and enterprises are difficult to further reduce prices to obtain orders. In terms of demand, with the approaching of nodes such as the year-end grid connection of energy storage and the decline of subsidies for replacing old power vehicles with new ones, the production volume of downstream battery cell enterprises has increased. At the same time, in addition to responding to the downstream demand, negative electrode enterprises also have the expectation of concentrated stocking. The production volume of negative electrodes is at a high level. However, the current price war in the downstream is still fierce, and there is still a strong demand for cost reduction transmitted to the negative electrode, and with the current release of some new production capacities, the industry competition is further aggravated, and the price of negative electrode materials continues to be under pressure and may still have a downward possibility.

Electrolyte:

This week, the price of electrolyte was temporarily stable. On the supply side, due to the slight fluctuation of the price of lithium hexafluorophosphate, electrolyte manufacturers mainly purchase lithium hexafluorophosphate according to demand. On the demand side, the demand of battery cell factories for electrolyte has increased. On the cost side, the price of lithium hexafluorophosphate has slightly increased, while the prices of solvents and additives are temporarily stable. Currently, the overall price of electrolyte is mainly affected by the prices of lithium carbonate and lithium hexafluorophosphate, but the increase is less than expected, and the price is temporarily stable. It is expected that in the short term, due to the influence of the cost side, the price of electrolyte will fluctuate slightly.

Separator:

This week, the price of lithium battery separator operated weakly and stably. On the supply side, although November is nearing the end of the year, the overall production schedule expectation in the fourth quarter is still at a high level, so the demand for separators is still guaranteed to some extent, and the operating rate of separator enterprises is guaranteed, and the material supply is relatively sufficient. From the demand side, there are certain benefits for the year-end power storage and consumption markets, and downstream enterprises often have the behavior of rushing to install and boost volume, and the purchasing demand of customers is strong. However, considering that some enterprises currently have a lot of surplus production capacity and there is still a situation of rushing for volume, or a situation of exchanging price for volume may occur. At the same time, under the background of severe internal competition in the downstream, in order to achieve cost reduction and efficiency improvement, they will continue to exert pressure on the upstream separator price, so the separator price is still under pressure and may have a downward possibility in the future.

Waste Lithium Batteries:

This week, the price of lithium battery recycling waste was relatively stable. This week, the price of lithium salts showed fluctuations within a certain range. However, since the price of lithium salts increased after the plunge in mid-October and the hedging in the futures market can stabilize profits, it has not had a significant impact on the waste price from both the enterprise sentiment side and the price side. The expected prices between powder-making factories and wet-process factories are also gradually becoming unified. From the market perspective, the partial release of bus used batteries in the early stage had limited stimulation on the market, and the price of used batteries was also relatively stable. At this stage, lithium battery recycling enterprises still hold a wait-and-see attitude towards the long-term price of lithium salts, and the overall sentiment is slightly pessimistic. And due to the recent large changes in the price of lithium salts, some enterprises have the behavior of reducing inventory, and the purchasing sentiment is still relatively low, and the market transactions are still mainly based on order rigid needs.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

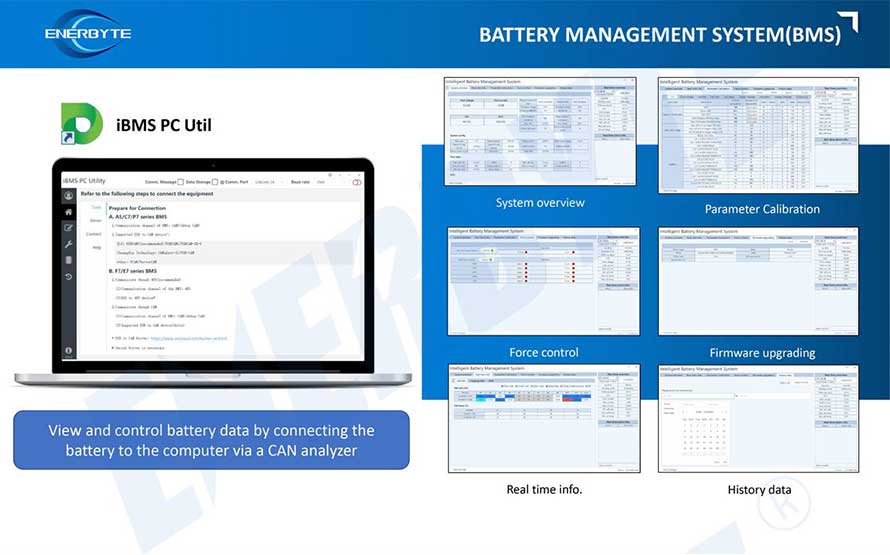

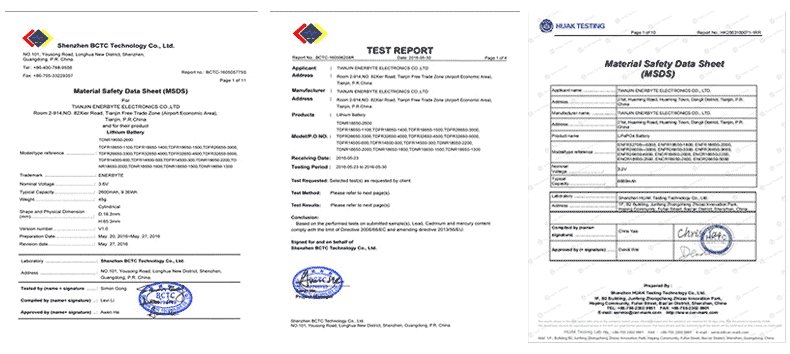

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline