24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Recently, Tianqi Lithium released its third quarter financial report, which showed that its third quarter revenue was 1.47 billion yuan, a year-on-year decrease of nearly 5%, and the first three quarters revenue was 4.76 billion yuan, a year-on-year increase of nearly 20%.

Recently, Tianqi Lithium released its third quarter financial report, which showed that its third quarter revenue was 1.47 billion yuan, a year-on-year decrease of nearly 5%, and the first three quarters revenue was 4.76 billion yuan, a year-on-year increase of nearly 20%. The net profit attributable to shareholders of listed companies in the third quarter was 380 million yuan, a year-on-year decrease of nearly 36%, and 1.689 billion yuan in the first three quarters, a year-on-year increase of 11.2%.

Revenue and net profit of Tianqi Lithium in the first three quarters:

The market price of lithium is not everything

As the "master of lithium" who dominated the world a few years ago, the prestige is no longer there. Compared with the price of 160000 yuan/ton at the beginning of the year, the price of lithium carbonate alone can only begin with seven words, which has dropped nearly 1.1 times.

(The decline in lithium prices has dragged down profits)

While lithium production capacity and supply continue to increase, the demand for lithium downstream has lagged behind. The current situation of oversupply makes the lithium price frequently under pressure. According to SMM research, China's lithium carbonate production capacity may exceed 250000 tons in 2018, and the penetration rate of salt lake lithium production capacity is 20%. The continuous release of production capacity has made 2018 the turning point of lithium carbonate supply and demand in China, and the supply and demand pattern has officially shifted from tight balance to loose excess supply.

Capacity structure of lithium salt in China from 2017 to 2020:

(Continuously expanded capacity)

Western Securities believes that the revenue of Tianqi Lithium fell slightly in the third quarter, its cost advantage decreased, and its gross profit margin declined. It is expected that the price of lithium salt products in the affected industry will fall. In the third quarter, the price of battery grade lithium carbonate in the industry dropped by more than 30% on a year-on-year basis, but the growth rate of the company's revenue only fell by less than 5%. It is estimated that the reason is that the company's product quality, customer structure and product price performance are better than the industry average. Second, the company's sales volume has released rapidly and increased year on year, realizing profits. Finally, the company's gross profit margin in the third quarter was 64.7%, down 9.0 percentage points and 6.7 percentage points on a month on month basis, respectively. The decline was relatively small compared with the price decline. It is expected that the company has the advantage of strengthening cost control and resource endowment, and has mastered high-quality mineral resources Talison.

Steadily expand production of lithium salt and supplement price with quantity

In May 2018, Tianqi Lithium announced that it planned to purchase 3.77% of the equity of overseas salt lake enterprise SQM23.77%. During the reporting period, the company disclosed the progress announcement of major asset purchase, and the acquisition continued to advance. Talison, which is controlled by the company, launched the "expansion of chemical grade lithium concentrate" project in March 2017, and plans to increase the production capacity to 1.34 million tons/year; According to the report, in July this year, the Board of Directors approved the construction of the third chemical grade lithium concentrate production plant, which is planned to increase the lithium concentrate production capacity to about 1.95 million tons. Huatai Securities believes that Tianqi Lithium will continue to improve its control over lithium resources through expansion, acquisition and other measures, and its leading position in the medium and long term is expected to continue to consolidate.

At present, various projects of Tianqi Lithium continue to advance. Although lithium salt processing enterprises with self-sufficient upstream raw materials have suffered a decline in the company's profitability due to the drop in lithium prices, if the output can be significantly increased, it will make up for the impact of the price drop to a certain extent and is expected to drive performance growth. According to the prediction of Huatai Securities, from 2019 to 2020, the company's production capacity will achieve a significant increase, bringing about a significant increase in the scale of lithium salt. By 2020, the company's lithium salt production capacity is expected to exceed 100000 tons.

Three fee pressure inhibits performance growth

Due to the planned acquisition of SQM and the intermediary fees for the proposed issuance of H shares, the company's administrative expenses and financial expenses increased significantly. According to the calculation of Western Securities, in the third quarter, the company's administrative expenses increased by 31% to 87 million yuan on a year-on-year basis due to intermediary consulting fees, and the financial expenses increased by 389% to 117 million yuan on a year-on-year basis due to the increase in net interest expenses. Intermediary fees have pushed up management fees, and financial pressure has increased.

Financial data of Tianqi Lithium in the third quarter (unit: million yuan)

Huatai Securities believes that among the substantially increased expenses, the administrative expenses are due to the increase of intermediary expenses for the purchase of SQM shares and the proposed issuance of H shares, while the financial expenses are mainly due to the increase of interest expenses and exchange losses due to the increase of borrowings.

According to the forecast of the business performance of Tianqi Lithium in 2018, the net profit attributable to shareholders of listed companies in this year will vary from - 6.76% to 4.89%, with a range of 2 to 2.25 billion yuan. The Company believes that the main reasons for the change in performance are the increase in exchange losses, the increase in interest expenses due to the increase in borrowing, and the increase in intermediary costs due to the purchase of SQM shares. At the same time, the delivery time for the purchase of SQM23.77% shares has not been finalized. The above performance forecast does not take into account the impact of the completion of the transaction on the Company's performance.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

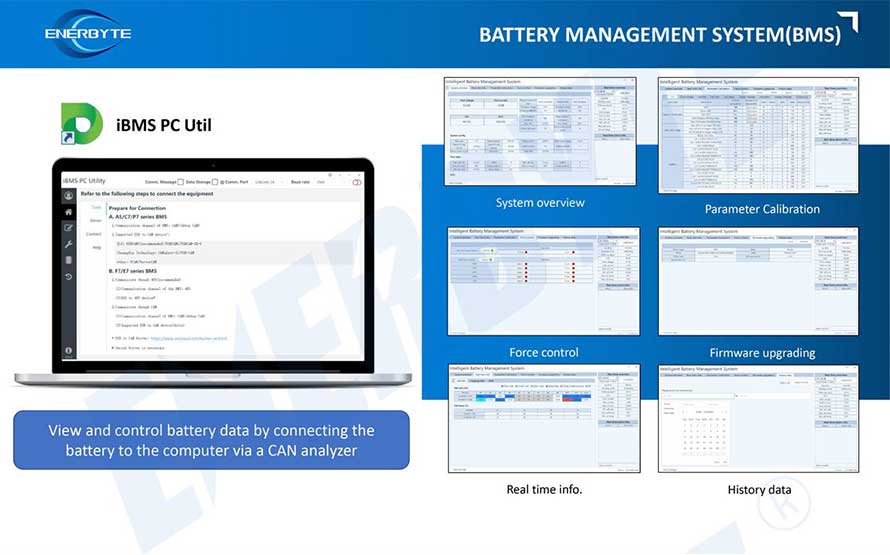

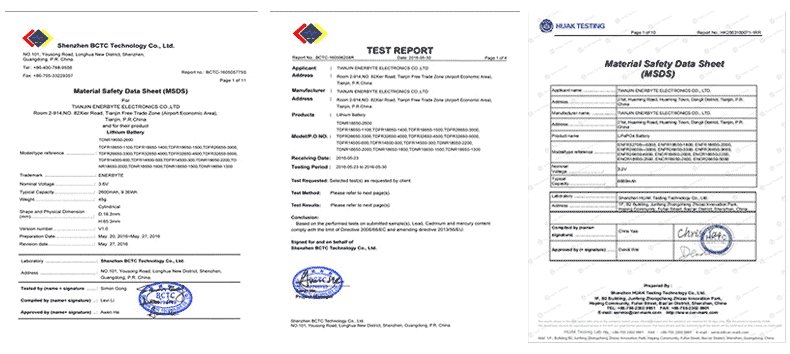

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline