24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Introduction: With the rapid development of new energy vehicles, a large number of lithium battery companies are vying to go public and compete in the capital market. On June 30th, Jiangsu Huasheng Lithium Battery Materials Co., Ltd. (referred to as "Huasheng Lithium") applied for listing on the Science and Technology Innovation Board and was accepted. Huatai United Securities is its sponsor, with a planned fundraising of 700 million yuan.

According to information, Huasheng Lithium Battery was founded in 1997 and is a high-tech company specializing in the research and development, production, and sales of lithium battery electrolyte additives. The company's products mainly include two series: electronic chemicals and special organic silicon. The company's products mainly include two series of electronic chemicals and special organic silicon, which have highly covered the domestic market in China. At the same time, they are exported to countries and regions such as Japan, South Korea, the United States, Europe, and Southeast Asia.

In the field of electronic chemicals, the company is one of the leading suppliers of vinyl carbonate (VC) and fluoro ethylene carbonate (FEC), whose products are widely used in new energy vehicles, electric two wheeled vehicles, electric tools, UPS power supply, mobile base station power supply, photovoltaic power stations, 3C products and other fields.

The acceleration of the new energy industry drives the rapid expansion of the lithium battery market

In terms of financial data, Huasheng Lithium Electric's revenue in 2018, 2019, and 2020 was 369 million yuan, 423 million yuan, and 445 million yuan, respectively; The corresponding net profits for the same period were 60951900 yuan, 76083400 yuan, and 77366200 yuan, respectively. At present, the gross profit margin in the field of electrolyte additives is considerable. With the acceleration of competition and differentiation in the same industry, companies with technology and product reserves are expected to further expand their market share.

The Era of Post Subsidies Comes with Both Risks and Opportunities

(1) Risk of production restrictions, shutdowns, or penalties due to inability to meet increasingly stringent environmental policies

With the increasing emphasis on environmental protection by the country and society, environmental management efforts are constantly increasing, and relevant departments may issue and adopt higher environmental standards. If the company fails to meet the corresponding requirements in a timely manner when there are changes in environmental protection policies, it may be restricted or suspended, or face the risk of environmental penalties.

In 2018, the subsidiary of the company, Taixing Huasheng, was subject to two administrative penalties by the Taizhou Environmental Protection Bureau for exceeding the emission limit of atmospheric pollutants and abnormal operation of solid waste incinerator exhaust gas pollution prevention and control facilities.

(2) Risk of performance decline caused by changes in support policies for the new energy vehicle industry

Since the State Council took the new energy vehicle industry as a strategic emerging industry in 2010, many ministries and commissions have continuously issued a series of laws and policies to support, encourage and regulate the development of the new energy vehicle industry. The new energy vehicle industry has developed in high quality, but affected by the subsidy retrogression policy, the production and sales of new energy vehicles have both declined in the second half of 2019. Since 2020, the impact of the subsidy retrogression policy has superimposed the impact of the COVID-19 epidemic, This led to a further decline in the new energy vehicle market in the first half of 2020.

With the decline of government subsidies, intensified competition in the upstream and downstream of the lithium battery industry chain, and overcapacity, lithium battery companies generally face significant financial pressure. Seeking capital market financing through listing is an important means of future development and also an inevitable choice for a company to grow.

(3) Risks of land use for fundraising projects not yet implemented

According to the disclosed prospectus, Huasheng Lithium Battery plans to publicly issue 28 million shares, which shall not be less than 25% of the total share capital after the issuance; We plan to raise 700 million yuan to raise funds, and the fundraising project is planned to be implemented in Jiangsu Yangtze River International Chemical Industry Park in Zhangjiagang City. However, it is worth noting that as of the signing date of the prospectus, Huasheng Lithium Electric has not yet obtained the state-owned land use rights for the above-mentioned land for fundraising and investment.

Summary:

With the development of the industry and the iteration of technology, new technological paths such as hydrogen fuel power cells and solid-state lithium batteries may have an impact on existing liquid lithium batteries. In line with industry development trends, capital driven technological progress or transformation has become an inevitable choice.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

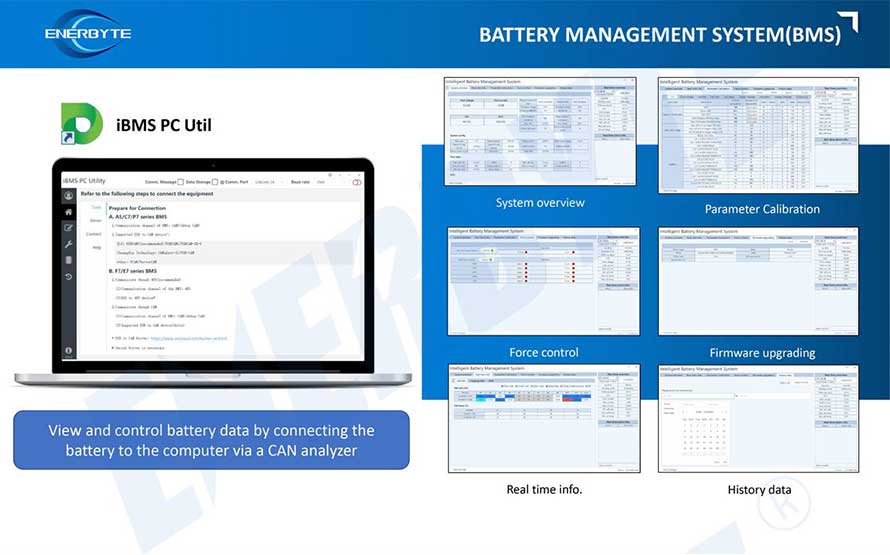

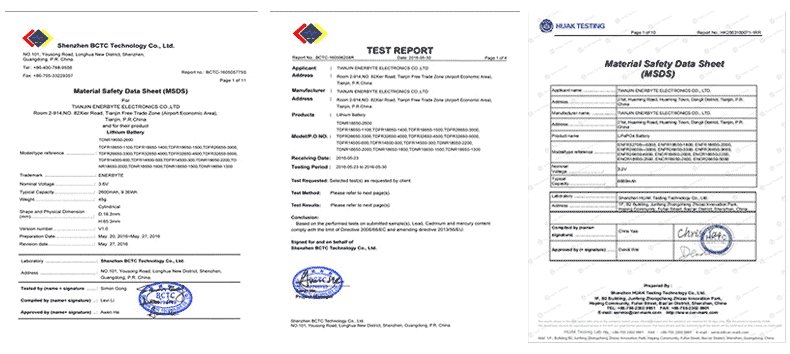

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline