24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

On the evening of July 14th, Ganfeng Lithium (002460. SZ) and Tianqi Lithium (002466. SZ), the two major "lithium kings" in the A-share market, simultaneously announced a notice and revised the performance forecast for the first half of 2021.

In the 2021 semi annual performance forecast revision notice of Ganfeng Lithium Industry, the net profit attributable to shareholders of the listed company before the revision ranged from 800 million yuan to 1.2 billion yuan. After the revision, it significantly increased to between 1.3 billion yuan and 1.6 billion yuan.

Even the revised lowest value of Ganfeng Lithium is higher than the highest value before the correction!

Ganfeng Lithium Industry Announcement

Ganfeng Lithium stated in the notice that the reason for the correction of the performance forecast is that during the performance forecast period, the company's product prices exceeded expectations; The second reason is that during the performance forecast period, the fair value of financial assets such as Pilbara held by the company increased.

In the 2021 semi annual performance forecast revision notice of Tianqi Lithium Industry, the net profit attributable to shareholders of the listed company before the revision was a loss of 130 million to 250 million yuan. After the revision, it directly turned losses into profits, with an expected profit of 78 million to 116 million yuan.

Tianqi Lithium Industry Announcement

Tianqi Lithium stated in the notice that the reason for the correction of the performance forecast is firstly the change in SQM's stock price, which resulted in a higher than expected increase in the fair value change income of SQM's B-share collar option business held by the company; Secondly, during the reporting period, the sales volume and average sales price of the company's important lithium compound products increased compared to expectations; The third reason is that the exchange rate fluctuations between the US dollar and the Australian dollar have resulted in exchange losses exceeding expectations.

The top two reasons for Tianqi Lithium are basically similar to Ganfeng Lithium, but the third reason actually puts pressure on Tianqi Lithium. But even with negative factors, Tianqi Lithium still turns losses into profits, which is even more commendable!

In the secondary market, Ganfeng Lithium Industry rose 8.07 yuan or 5.05% on July 15th, closing at 167.79 yuan per share. The current total market value is 241.2 billion yuan, just one step away from the 250 billion yuan market value threshold.

Tianqi Lithium Industry gained even more on July 15th, rising 6.68 yuan/share, or 9.51%, to close at 76.90 yuan/share. The current total market is 113.6 billion yuan.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

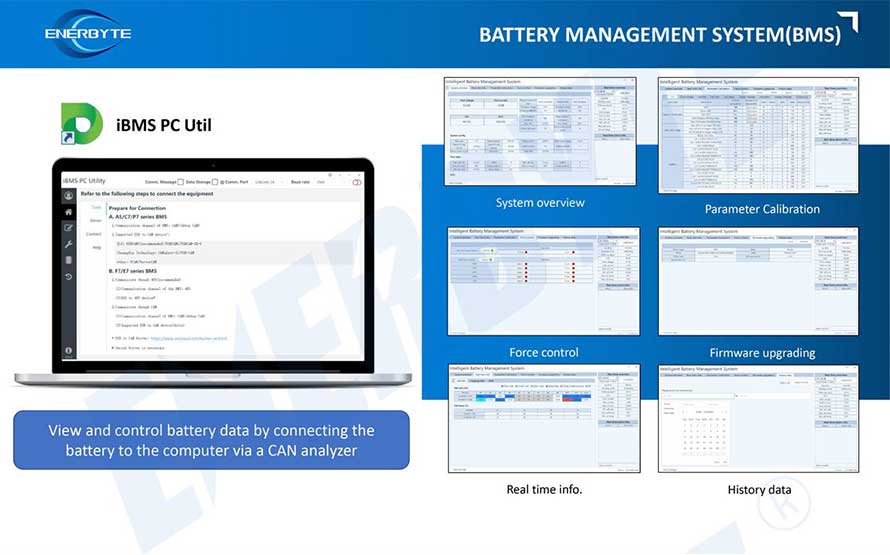

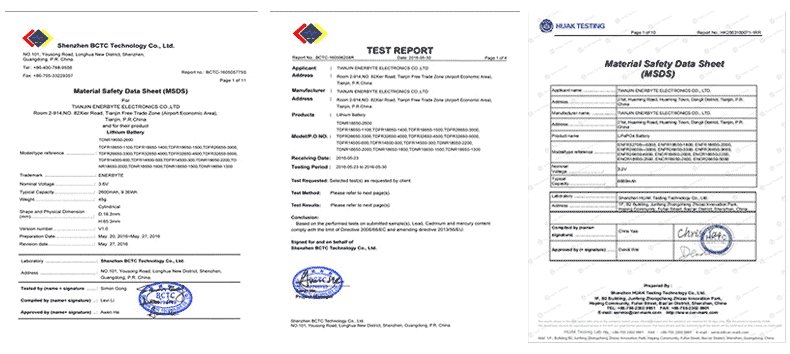

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline