24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

On the evening of August 26th, Ganfeng Lithium Industry announced the progress notice on the wholly owned subsidiary Shanghai Ganfeng's tender offer for Bacanora Company, which involves mining rights investment and related party transactions. Recently, the company received a notice from Shanghai Ganfeng that Shanghai Ganfeng has officially issued a legally binding tender offer for all issued shares of Bacanora Company.

The notice indicates that before the completion of this tender offer, Shanghai Ganfeng held 28.88% of the shares of Bacanora Company; If this tender offer is successful, Shanghai Ganfeng will ultimately control Bacanora Company and hold no more than 100% of the company's shares.

The notice also pointed out that the tender offer still requires Bacanora shareholders to fulfill the acceptance process, and the final shareholding ratio depends on the result of Bacanora shareholders' acceptance process.

Drive to 'Double Yellow Eggs'

According to the announcement released in early May, the amount of this tender offer transaction does not exceed £ 190 million.

However, Weike Lithium Battery noticed that when the tender offer announcement was announced in early May, the delivery procedures for Shanghai Ganfeng to increase its shareholding in Bacanora to 28.88% were still being processed. At that time, the announcement stated that after the tender offer was completed, Shanghai Ganfeng would hold 100% of Bacanora's equity, and in this progress announcement, it was changed to "holding no more than 100% of the company's shares".

Source: Ganfeng Lithium Industry Announcement

The changes in the description of Shanghai Ganfeng's final shareholding ratio in Bacanora before and after the announcement are subject to final confirmation by Ganfeng Lithium's subsequent disclosure announcement. However, this does not affect Shanghai Ganfeng's ultimate control of Bacanora Company, nor does it affect Ganfeng Lithium's acquisition of the world's largest lithium resource project, and it may also have the effect of opening up a double yellow egg.

According to data, Bacanora is a company established in 2018 and listed on the AIM section of the London Stock Exchange in the UK. Its main business is group holding and lithium clay resource project management. Its important asset is the lithium clay Sonora project located in Mexico.

The Sonora project is a lithium clay extraction project located in Mexico, and is currently one of the largest lithium resource projects in the world. Shanghai Ganfeng and Bacanora each hold 50% equity in the project. According to the feasibility study report of the Sonora project, the total lithium resource of the project is approximately 8.82 million tons of lithium carbonate equivalent.

Thanks to the unique advantages of lithium clay resources, the lithium extraction process of this project is characterized by the ability to simultaneously combine the advantages of ore lithium extraction and salt lake lithium extraction. It can complete the lithium extraction process in a short time at a speed similar to ore lithium extraction, and can also complete the lithium extraction process at a lower cost similar to brine lithium extraction. At present, the project has not yet been put into operation, and it is expected that the annual production of lithium hydroxide after the first phase of the project is put into operation will be 20000 tons.

It is worth noting that on August 25, Mark Hohnen, Chairman of Bacanora, said, "We are glad that Bacanora can effectively cooperate with Gan Feng and reach an agreement on the terms of the formal acquisition offer." Bacanora also said that, as part of the transaction, its shareholders will now also obtain the shares of ZinnwaldLithium listed in the London alternative investment market, and Bacanora holds 36% of the company's shares.

Bacanora stated that with these stocks, the premium will increase to 63%, and according to the May acquisition announcement, Ganfeng Lithium's £ 190 million bid is already 50% premium to Bacanora's closing price on May 5th.

It is understood that Zinwald has a market value of 66 million euros and is developing a lithium mine in Germany, 35 kilometers away from Dresden. Meanwhile, Zinwald stated in a statement that the company looks forward to continuing cooperation with potential new shareholders.

From this, it can be seen that the Sonora project and ZinwaldLithium are the "double egg yolks" developed by Ganfeng Lithium through Bacanora Company. Of course, whether ZinwaldLithium can become a mature "egg yolk" depends on Ganfeng Lithium's planning.

The global "lithium king" seems to be born

Ganfeng Lithium Industry is truly the "lithium king", and currently has 8 high-quality lithium resources directly or indirectly worldwide. The details are as follows:

1. 50% equity in the MountMarion spodumene mine (currently producing 400000 tons/year) in Australia, and 6.33% equity in the PilbaraPilgangoora spodumene mine;

2. 51% equity in Cauchari Olaroz lithium salt lake (containing approximately 24.58 million tons of LCE) and 88.75% equity in Mariana lithium salt lake in Argentina;

3. 50% interest in Sonora lithium clay in Mexico;

4. 55% interest in Avalonia spodumene ore in Ireland;

5. We have 100% equity in the Ningdu Heyuan spodumene mine and 100% equity in the Fenghuangtai deep brine lithium mine of the Qinghai Mangya Xingwei mine in China.

In addition, on July 17th, Ganfeng Lithium's wholly-owned subsidiary, Ganfeng International, made a tender offer to acquire Canadian Millennial, which holds 100% equity in the PastosGrandes lithium salt lake project and the CauchariEast lithium salt lake project.

From this, it can be seen that the lithium resource equity reserves of Ganfeng Lithium Industry have once again significantly increased.

According to the analysis of domestic and foreign research institutions, as the sales of electric vehicles continue to rise, resources will become the king in the future, and the structural shortage of lithium concentrate is gradually becoming a trend. It is expected that the price of lithium concentrate is expected to accelerate the upward trend.

As the "lithium king", Ganfeng Lithium Industry can be said to have astonishing foresight, or it can be said that it has already carried out lithium resource layout at home and abroad in the first half of this year by loving and buying.

On June 14th, Ganfeng Lithium announced that Ganfeng International plans to acquire 50% equity of Dutch SPV Company for $130 million (approximately 832 million RMB). After the investment is completed, the Goulamina project will obtain a 50% underwriting right for the annual production of approximately 455000 tons of spodumene concentrate. If Ganfeng Lithium directly provides financial support or assists LMSA in obtaining funding from third-party banks or other financial institutions, it can obtain the underwriting right for the remaining 50% of the production in the first phase of the project. That is to say, Ganfeng Lithium Industry will indirectly own 100% exclusive sales rights of 455000 tons/year of pyroxene concentrate.

On May 28th, Ganfeng Lithium announced that Ganfeng International would invest $15 million of its own funds in the deliverable bonds of SRN listed companies. After 6 months of effective investment, the company has the right to convert 100% of its tradable profits into 25% equity of FE Company (holding TAS laterite nickel assets). At the same time of equity conversion, the company has the right to increase its shareholding in FE Company to 50% for an additional consideration of $15 million. If exercising its rights, Ganfeng International will acquire 50% equity of FE Company for a cumulative consideration of 30 million US dollars (approximately 194 million RMB).

On March 8th, Ganfeng Lithium decided to acquire 100% of the property shares of Yili Hongda with its own funds of RMB 1.47 billion, thereby indirectly holding 49% of the equity of Wukuang Salt Lake and obtaining the equity of the Qinghai Chaidamu Yiliping Lithium Salt Lake project.

Battery Business Acceleration

Compared to Ganfeng Lithium's strong raw material production and rapid expansion, the market's attention to Ganfeng Lithium's battery business is not so high. The actual situation is that lithium batteries are an important part of the Ganfeng Lithium Industry's lithium battery ecosystem layout, an important business sector, and together with upstream lithium resources, lithium compounds, metal lithium, and lithium battery recycling, form the Ganfeng Lithium ecosystem of five major business sectors.

According to Ganfeng Lithium's 2020 annual report, the company's revenue from lithium battery series products in 2020 was approximately 1.268 billion yuan, an increase of 110.33% year-on-year, accounting for 22.96% of its total revenue.

It is reported that Ganfeng Lithium's lithium battery business mainly includes consumer batteries, TWS batteries, power/energy storage batteries, and cutting-edge solid-state batteries.

Time has come this year, and Ganfeng Lithium has started to focus on the power lithium battery business.

1. 8.4 billion yuan investment in lithium battery projects

On August 5th, Ganfeng Lithium announced that it agreed to invest 8.4 billion yuan from its own funds in the construction of a new type of lithium battery project with an annual production capacity of 15GWh.

Specifically, Ganfeng Lithium plans to invest 3 billion yuan in the construction of a new type of lithium battery project with an annual production capacity of 5GWh in Xinyu High tech Zone, Jiangxi; We plan to establish a new independent legal entity project in Liangjiang New Area, Chongqing, with an investment of 5.4 billion yuan to construct a 10GWh new lithium battery technology industrial park and an advanced battery research institute project.

It is worth noting that solid-state batteries are a major highlight of this investment project.

In the construction of the Liangjiang New Area project in Chongqing, it includes the construction of a 10GWh lithium battery production and manufacturing base. After cooperation between Ganfeng Lithium or its holding company and Chongqing New Energy Vehicle Company, Ganfeng Lithium has established an Advanced Battery Research Institute in Chongqing to provide technical support for the technological updates and product iterations of various solid-state batteries, and jointly carry out application technology research and development with downstream customers such as automobiles and consumer electronics.

2. Solid state battery loading is imminent

On July 16th, Ganfeng Lithium Battery and Dongfeng Company's Technology Center officially signed a contract to negotiate cooperation on solid-state battery demonstration and operation, and signed a solid-state battery E70 model demonstration and promotion agreement.

According to the Dongfeng Technology Center, this year, Dongfeng will be the first to complete the announcement of solid-state battery vehicles and complete vehicle delivery before the Spring Festival. Through demonstration operation mode, it will quickly seize the commanding heights in the field of solid-state battery technology. It is expected that in early 2022, Ganfeng lithium-ion solid-state batteries may be the first to be installed in the Dongfeng E70 model, and vehicle delivery and demonstration promotion will be completed.

3. Lithium iron phosphate battery starts loading

In June, the 345th batch of "Road Motor Vehicle Production Companies and Product Notices" announced by the Ministry of Industry and Information Technology of the People's Republic of China showed that Chery Group and Qilu Automobile cooperated to develop and apply for the Qilu Automobile CostinEC1 sedan, with a supporting battery type of lithium iron phosphate, and the battery comes from Ganfeng Lithium Industry.

It can be seen from this that the solid state battery of Ganfeng Lithium will be loaded at the beginning of next year, and the lithium iron phosphate battery of Ganfeng Lithium has started to be loaded, and has invested heavily in the construction of lithium battery projects. All kinds of actions send a powerful signal, that is, the upstream "lithium king" has joined the battery battle!

Market value skyrocketed by 123.7 billion yuan

Western Securities stated that Ganfeng Lithium has established a vertically integrated business model that integrates upstream resource development, midstream lithium salt production, downstream batteries and recycling, and has a diversified lithium salt product layout.

As of the close of August 27th, Ganfeng Lithium reported 196.35 yuan/share, up 8.25 yuan/share, or 4.39%, with a total market value of 282.2 billion yuan. Compared to the total market value of 158.5 billion yuan at the close of August 12th, it surged by 123.7 billion yuan in half a month.

In terms of performance, on July 14th, Ganfeng Lithium revised its 2021 semi annual performance forecast. The net profit attributable to shareholders of the listed company before the revision was between 800 million yuan and 1.2 billion yuan. After the revision, it significantly increased to between 1.3 billion yuan and 1.6 billion yuan.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

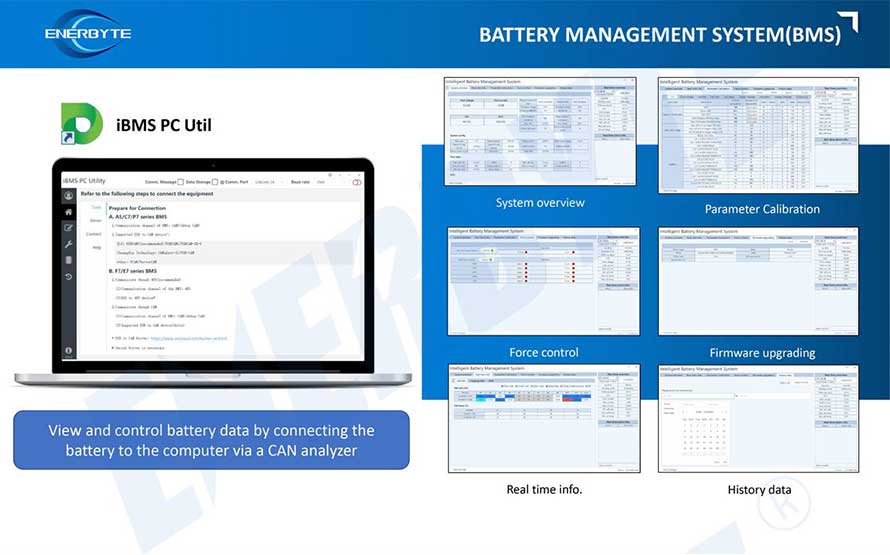

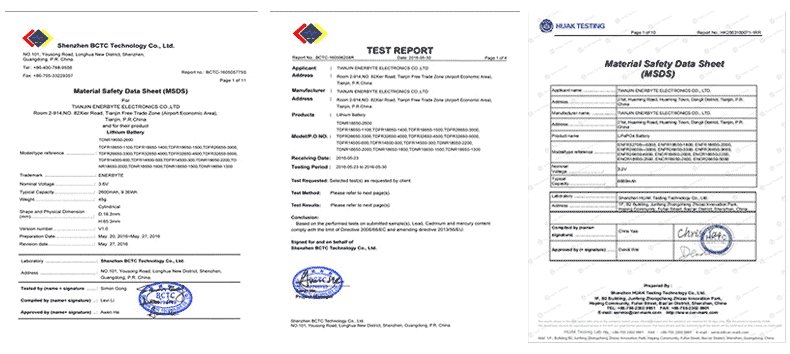

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline