24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Regarding the lithium industry, there are two major news points worth paying attention to.

On September 14th, the main lithium mining company in Australia, Pilbara, conducted the second spodumene concentrate on the BMX electronic platform. As of press release, it has been completed, and the final price for this time is 2240 USD/t, greatly exceeding market expectations.

Webpage Screenshot

According to the calculation of Haitong Securities, considering the sea freight, the production cost of lithium salt is more than 150000 yuan; Considering the reasonable profit of the lithium salt factory, the corresponding lithium price will definitely exceed 200000 yuan.

On July 29th, when the price of lithium concentrate was quoted at 740 US dollars per ton on the Asian Network, Pilbara's first spodumene concentrate on the BMX platform was priced at a high price of 1315 US dollars per ton, which once "shocked" the market and subsequently contributed to the lithium ore price boom.

After that time, the entire range of lithium products entered an accelerated rise, and during the two periods, the price of lithium concentrate increased from $740 to $990; The quotation for electric carbon increased from 90000 yuan to 144000 yuan; The quotation for lithium hydroxide increased from 97500 yuan to 150000 yuan. It can be said that the price of Pilbara can contribute to the price of lithium.

Coincidentally, a lithium industry giant has also made major moves, namely Tianqi Lithium (002466. SZ), a scarce company with high-quality lithium mineral resources.

On September 13th, Tianqi Lithium announced that the board of directors had reviewed and approved a number of proposals, including the Proposal on the Issuance of H-share Shares by Companies and Their Listing on the Main Board of the Stock Exchange of Hong Kong Limited, and announced the work plan to launch the issuance of H-share shares and their listing on the Main Board of the Stock Exchange of Hong Kong Limited.

Tianqi Lithium Industry Notice

The work plan needs to be submitted to the Company's third extraordinary shareholders' meeting in 2021 for deliberation, and the relevant shareholders' meeting will be held on September 29th.

The announcement states that, on the premise of complying with regulatory regulations such as the minimum issuance ratio of the company's shares in the place where they are listed, and in combination with the capital requirements of the company's future business development, the number of H shares issued this time does not exceed 20% of the company's total capital stock after the issuance, or the minimum issuance ratio requirements of the company's shares in the place where they are listed, and grants the lead underwriter an over allotment option of not more than 15% of the above issued H shares.

The Proposal on the Plan for the Use of Funds Raised from the Issuance of H Shares by Companies states that the funds raised from the issuance of overseas listed foreign capital shares (H shares) will be used for the following items (including but not limited to) after deducting the issuance expenses: existing repayment, production expansion, and replenishment of working capital.

Tianqi Lithium Industry Notice

Going public in Hong Kong to solve the financial difficulties

Tianqi Lithium has always had a demand for equity refinancing.

Previously, Tianqi Lithium acquired approximately 23.77% of equity in Talison Lithium Resources and SQM, the world's largest salt lake lithium mine, in 2014 and 2018, respectively.

The acquisition of high-quality lithium resources has enabled Tianqi Lithium to have a high resource self-sufficiency rate in the industry, but at the same time, the leverage Tianqi Lithium leverages has also led to huge losses for the company.

According to Tianqi Lithium's 2021 semi-annual report, the company's total assets are 41.3 billion yuan, with a net asset attributable to shareholders of the listed company of about 5 billion yuan, and an asset ratio of nearly 88%.

On July 5, 2021, Tianqi Lithium announced that its overseas wholly-owned subsidiary TLEA had introduced a strategic investor, IGO, an Australian listed company, through capital increase and stock expansion, with a total capital increase of $1.395 billion. Among them, $1.2 billion was used to repay the principal and all interest of the acquisition loan arising from the acquisition of the equity of SQM Company, which initially alleviated the pressure on Tianqi Lithium.

Due to the fact that the completion date of the transaction has exceeded the reporting period of the semi-annual report, this capital increase and share expansion has not been reflected in the 2021 semi-annual report data. However, according to the statement made by the management of Tianqi Lithium at the investor relations event on August 30th, the capital increase from IGO had a positive impact on the company's finances. As of that time, the principal balance of merger and acquisition loans was approximately $1.873 billion, the company's asset ratio decreased to approximately 63%, the asset structure improved, cash interest expenses decreased, and financial expenses significantly decreased.

Regarding the remaining, Tianqi Lithium stated at the time that it would use methods including but not limited to the introduction of strategic investors at home and abroad, H-share issuance, private placement, and market-oriented debt to equity swap to resolve the pressure as soon as possible.

It now seems that the next step for Tianqi Lithium is already the issuance of H-shares.

Tianqi Lithium is rich in lithium resources

In May this year, when Tianqi Lithium replied to investors on the interactive platform, it stated that Tianqi Lithium has laid out the world's highest quality lithium resources. For example, Talison, the owner of the Greenbushes spodumene mine, which is the world's best hard rock lithium mine, and SQM, the producer of the Atacama Salt Lake mining rights, which is the world's highest quality salt lake, are holding shares.

Currently, the raw materials for all lithium compound processing bases of Tianqi Lithium are sourced from Talison's Greenbushes Mine, which is the world's highest grade, largest reserves, and lowest cost solid spodumene mine (lithium resource amount equivalent to about 8.78 million tons of lithium carbonate equivalent, and lithium reserve equivalent to about 6.9 million tons of lithium carbonate equivalent). Its lithium concentrate output can provide a strong resource guarantee for the company.

At the same time, the company has always regarded the Cuola spodumene mine in Yajiang, Ganzi as a medium to long-term and necessary resource reserve for the company. The amount of lithium resources owned by the Cuola spodumene mine is converted into about 630000 tons of lithium carbonate equivalent; The company holds 20% of the equity of Tibet Shigatse Zabuye Lithium Industry High Technology Co., Ltd. The amount of lithium resources owned by Shigatse Zabuye is converted into about 1.83 million tons of lithium carbonate equivalent.

In addition, Tianqi Lithium is accelerating its continuous expansion of production. In 2018, Talison's third phase lithium concentrate expansion plan was officially launched, and this June, the trial run of the expansion plan was advanced to 2024. Upon the completion of the project, Tianqi Lithium will achieve the target of increasing the output of chemical grade lithium concentrate to 1.8 million tons per year.

Currently, Tianqi Lithium produces 34500 tons of lithium carbonate, 5000 tons of lithium hydroxide, 4500 tons of lithium chloride, and 800 tons of metal lithium.

Product Price Rising and Performance Thickening

According to the 2021 midterm report of Tianqi Lithium, during the period from January to June this year, the company achieved operating revenue of 2.351 billion yuan, up 25.13% year-on-year; The net profit achieved was 85797500 yuan, up 112.32% year-on-year, and the company successfully turned losses into profits.

Behind the realization of turning losses into profits is the rising prices of the company's important products, lithium carbonate and lithium hydroxide. According to information released by Shanghai Nonferrous Metals Network, on September 13th, the maximum price of battery grade lithium carbonate reached 142000 yuan/ton; The highest price of battery grade lithium hydroxide is 150000 yuan/ton.

As a comparison, last August, battery grade lithium carbonate was only 40000 yuan/ton; In January of this year, the price of battery grade lithium hydroxide was only 63000 yuan/ton.

It is worth noting that the price of lithium products is still bullish in the future, and the popularity of spodumene concentrates indicates that the market is optimistic about lithium products.

Cinda Securities pointed out that entering the third and fourth quarters, the new energy vehicle and 3C markets will usher in a peak consumption season, but there is not much marginal increase in the supply side of lithium resources, and lithium prices are expected to accelerate comprehensively, hitting historical highs.

This is good for Tianqi Lithium.

summary

This is not the first time Tianqi Lithium has sprinted to the Hong Kong Stock Exchange. In 2018, Tianqi Lithium submitted the H-share issuance materials and received the approval document issued by China Securities Regulatory Commission in November of that year, approving the new issuance of no more than 328 million overseas listed foreign shares, with a validity period of 12 months. However, due to the downturn in the Hong Kong market and the expiration of issuance approval documents, the listing ended in failure.

But now it's different. The market is increasingly recognizing the importance of scarce resources, and the new energy industry is developing faster than expected.

Tianqi Lithium has a high probability of successfully issuing H shares this time.

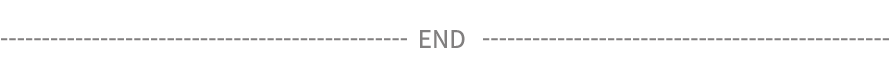

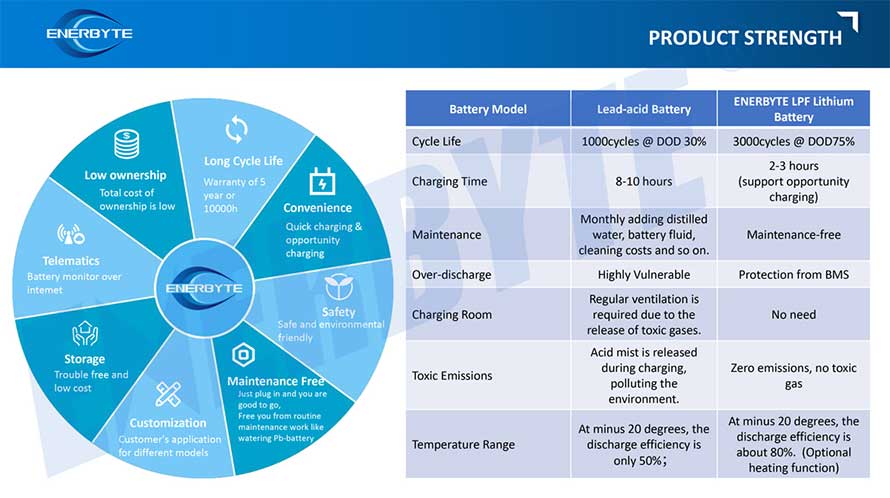

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

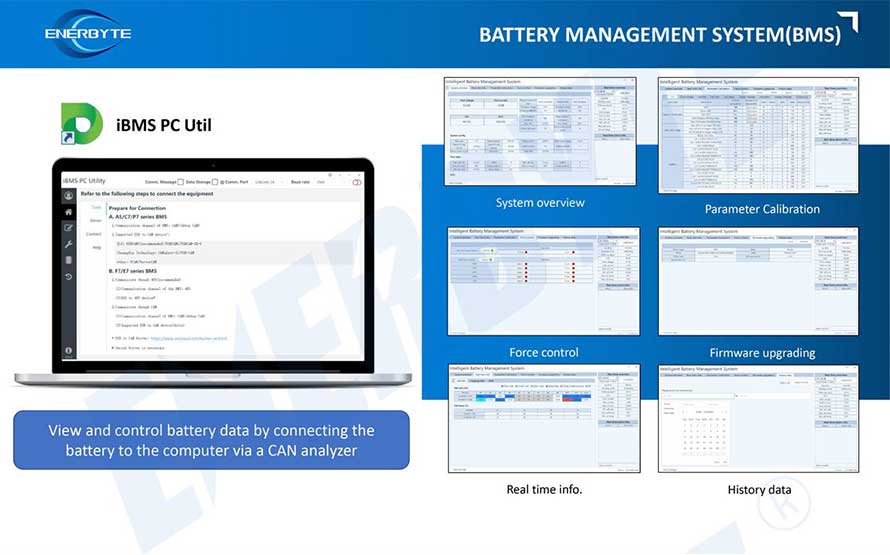

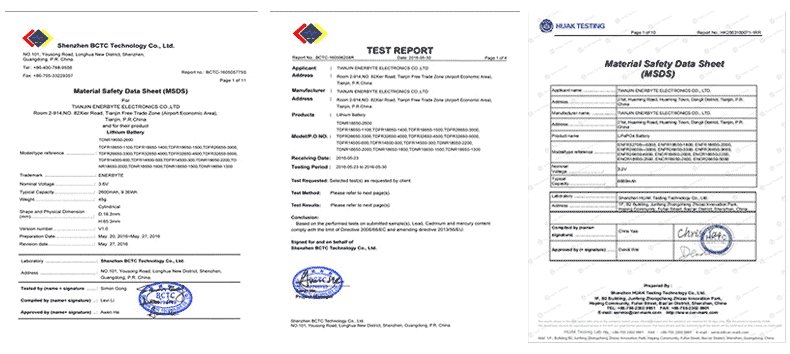

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline