24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

None of us can do the separator for the power lithium battery.

At the Guanghua New Year Forum at Peking University in early 2010, Miao Wei, then Vice Minister of Industry and Information Technology, said that the biggest problem limiting the development of new energy vehicles in China was batteries, while the biggest problem with batteries was the diaphragm.

At the end of the year, the global market share of membrane manufacturers in the United States and Japan was about 95%, while China accounted for only 4%. The products were concentrated in the middle and low end, and the demand for high-end membrane was basically dependent on imports. Although not everyone can do it, the situation is truly worrying.

In fact, when Miao Wei sighed, China's diaphragm industry was accumulating strength for diaphragm localization, with both manufacturers in high spirits expanding production, and newcomers emerging with high morale. In April of this year, a company called Shanghai Enjie New Material Technology Co., Ltd. (hereinafter referred to as Shanghai Enjie) was just registered and established. I'm afraid its founder, Li Xiaoming, would not dare to think that Enjie would become the world's largest film company in the future.

No one should doubt the strategic determination of China's new energy vehicles to change lanes and overtake, so companies in the industrial chain have set their hands free and started quickly. The lithium separator industry in China has rapidly risen, achieving domestic substitution within a few years, and China has occupied the largest share of the global lithium separator supply.

Those who are committed to new energy have received the dividends of the times, especially in 2021. In this year, the number of people and total wealth on Hurun's rich list increased by more than 20% compared to the previous year, and the rise of new energy related industries is one of the important reasons.

Among the top 10 companies with the largest increase in wealth, 8 are related to new energy. Zeng Yuqun, the founder of CATL, has increased his wealth by 200 billion yuan, ranking among the top three richest people in China for the first time with a wealth of 320 billion yuan. CATL's upstream membrane industry has also made a lot of money. Enjie's Li Xiaoming family has ranked among the top 100 richest people in China for the first time, and is firmly ranked as the richest person in Yunnan; The total wealth of Chen Xiufeng made of Xingyuan material has increased by more than three times.

The year 2021 is a major climax in China's new energy vehicle industry, and the situation in 2022 will not decrease. Each link in the industrial chain is very high, and the higher the situation, the more cautious it is. In terms of China's lithium battery separator industry, it is still necessary to cross several natural chasms, achieve the transformation from a diaphragm power to a diaphragm power, and complete the final step of counterattack.

This article attempts to answer the following three questions by reviewing the history of the rise of China's diaphragm industry:

1. Why is lithium battery separator important? Is it a good business?

2. How did China's lithium battery separator industry achieve its rise from scratch and from small to large?

3. Will China's lithium battery separator industry get stuck?

one

Is lithium battery separators a good business?

Battery fires are a major concern affecting consumers' purchase of new energy vehicles.

According to the data from the Fire and Rescue Bureau of the Emergency Management Department, in the first quarter of 2022, a total of 219000 fires were reported nationwide, including 19000 fires on various vehicles, including 640 new energy vehicle fires, up 32% year-on-year. At one time, seven new energy vehicles were criticized for burning down on a daily basis.

The fire accidents of new energy vehicles should be treated rationally. If we consider the growth in sales and the increase in ownership of new energy vehicles, in fact, the fire accidents of new energy vehicles are showing a downward trend.

Why should we mention that new energy vehicles are on fire? Because the membrane is the key material to prevent the battery from catching fire. Many battery fire accidents occur due to damage to the membrane.

Diaphragm is one of the four main materials of lithium batteries, known as the third electrode of lithium batteries. When positive electrode materials, negative electrode materials, and electrolytes were gradually made domestically, it was only in recent years that the membrane was freed from import dependence.

Generally speaking, a membrane is a layer of plastic film.

The membrane appears flat to the naked eye, but its surface is actually densely covered with nanoscale micropores. This micropore is the key to the use of membranes, and micropore preparation is also the core technology in membrane production.

According to different pore forming mechanisms, there are two types of membranes: dry method and wet method. Relatively speaking, wet method membranes have better overall performance and have gradually become the mainstream product in the market.

Membranes with micropores have two important uses:

One is that the membrane has a large number of zigzag micropores that can ensure the free passage of electrolyte ions to form a charge and discharge circuit.

The second is that when the battery is overcharged or the temperature rises, the membrane separates the positive and negative electrodes of the battery through a closed hole function to prevent direct contact and short circuit.

The quality of the separator directly affects the capacity, cycle, and safety of lithium batteries. Battery manufacturers are extremely strict in assessing the performance of the separator itself, with many indicators. Therefore, the separator is the link with the highest technical barriers among the raw materials for lithium batteries, and has the highest requirements for production equipment and manufacturing processes.

Diaphragm is a typical heavy asset industry, with fixed assets ranking first among the four main materials, especially equipment; The overall investment of a single GWh is second only to the cathode material.

Therefore, from the perspective of market entry, it is difficult to say that diaphragm is a good business. For those who do not have the financial strength and do not master high technical level, although the diaphragm is thin, the risk is high.

High risk often also means high returns. The gross profit margin of the diaphragm industry was once as high as 70%, which was quite attractive. With the development of technology and fierce market competition, the gross profit margin of the diaphragm industry has gradually decreased in recent years, but it has still reached a level of around 50%. From this perspective, diaphragm is another good business.

Another point worth noting is that the current concentration of the diaphragm industry is high, and the market share is mainly occupied by the top few large manufacturers. High market concentration is not very friendly for people who want to enter the diaphragm industry.

(Position of diaphragm in the new energy vehicle industry chain. Source: Xingyuan Material Financial Report)

two

start

The historical process of China's lithium battery separator industry can be roughly divided into three stages: before 2009, it was in the initial stage; From 2009 to 2015, the trend was rapid and the domestic substitution was accelerated; Since 2016, the production of head companies has expanded, and small companies have been eliminated. China's lithium battery separator industry has taken off and dominated the world.

The Institute of Chemistry of the Chinese Academy of Sciences was the first unit in China to engage in the research of lithium ion separators. In the early 1990s, it developed a dry biaxial stretching process with independent intellectual property rights. It has cooperated with some local companies, but the overall industrialization process has been slow.

During the Tenth Five Year Plan (2001-2005) period, the National 863 Plan deployed a lithium battery separator industrialization development project starting from basic raw materials, but there has been no substantive breakthrough. During this period, Zhongke Technology in Xinxiang, Henan, and Xingyuan Materials in Shenzhen were established successively, making them the first batch of membrane manufacturers in China.

In 2004, GREEN, a diaphragm brand owned by Zhongke Technology, took the lead in realizing the localization of diaphragm materials, whereby domestic diaphragms began to replace imported products in the mid and low end markets.

Interestingly, a person from the Institute of Chemistry of the Chinese Academy of Sciences wrote that the dry biaxial stretching process used by a company in Xinxiang, Henan Province, was obtained through abnormal means from the Institute of Chemistry of the Chinese Academy of Sciences.

In 2000, Chen Xiufeng, who had a trade background, was still opening a restaurant with his brother. I overheard that the profit margin of the diaphragm was very high, but our country did not have it at all, so we had to take goods from Japan.

Chen Xiufeng found a Japanese company and heard that it was a Chinese company that wanted to buy a diaphragm, so he first stated that he needed to pay for it before shipping it, and that he would have to call his company account 45 days in advance. He also reviewed the qualifications of the purchasing company to prevent the diaphragm from being applied to the batteries of,, and. If the other party determines that Chen Xiufeng's customer may have a purpose, he can terminate the cooperation at any time.

(Chen Xiufeng, Chairman of Xingyuan Material)

Since 2003, Chen Xiufeng has been selling diaphragm products from Japanese companies as an agent. After several business contacts, Chen Xiufeng felt more deeply: on the one hand, the domestic industry was constrained by the current situation, while on the other hand, it was attracted by rich profits. Finally, Chen Xiufeng decided to do it himself and must have a place in the diaphragm industry.

During the 11th Five Year Plan period (2006-2010), the 863 Plan proposes to achieve the localization of diaphragms. In 2006, Fosu Technology and BYD jointly funded the establishment of Jinhui High Tech, and shared some of the new energy vehicle projects in the 863 Plan. The important task is to upgrade the cell phone battery separator to an electric vehicle battery separator.

At this point, the three giants in the initial stage of China's membrane industry (Zhongke Technology, Xingyuan Materials, and Buddha Plastic Technology) have assembled. In 2010, the combined share of the three giants in the global diaphragm market was only 4%, and their products were concentrated in the middle and low end sectors. Later, the three giants had different destinies, but the Xingyuan material has remained strong until now.

three

Rising potential

At the beginning of 2009, the "Ten Cities Thousand Vehicles Project" was launched, and the number of demonstration cities increased to 13 by the middle of the year. The wave of new energy vehicles in China has officially begun.

In 2012, the "Energy Conservation and New Energy Vehicle Industry Development Plan (2012-2020)" proposed to strengthen research on key core technologies of new energy vehicles, accelerate the development of key materials such as positive and negative electrodes, separators, electrolytes, and other equipment for production, control, and testing of power lithium batteries.

The general trend of new energy vehicles has boosted the prosperity of domestic membranes, and China's membrane industry has begun to take off. Old diaphragm manufacturers such as Xingyuan Material, Jinhui High Technology, and Cangzhou Pearl have invested heavily to build new production lines and expand production, while new players are springing up one after another.

Before 2010, there were no more than 5 companies in China that could produce diaphragms. The Securities Times reported in October 2012 that nearly 50 companies in China are currently constructing and planning to launch lithium battery separator projects.

The first wave of diaphragm fever in China has emerged, and the situation is improving. However, the diaphragm craze has also caused industry insiders to reflect: a large number of companies have emerged in the lithium battery diaphragm field in a short time, which has brought not joy but concern to the industry.

At that time, there was a large discrepancy between the actual output and the planned output of domestic diaphragms, resulting in a low yield. The performance of domestic diaphragm products is relatively good, but there are problems with the stability and consistency of mass production. At the same time, domestic diaphragms are mainly concentrated in the middle and low end fields, while high-end diaphragms are still lacking.

Domestic separators mainly focus on the low end, which is due to technical constraints on the one hand, and the other hand, because the important application field of lithium separators at that time was not power batteries, but lithium batteries for digital products. Relatively speaking, lithium batteries for digital products should not have very high-end separators.

However, industry insiders can see that the demand for lithium batteries for digital products has stabilized and the proportion has shown a downward trend, while lithium power batteries are expected to experience an explosive rise.

Therefore, in order to survive, membrane manufacturers are also, to some extent, preparing for the upcoming wave of new energy vehicles.

Although there are still gaps, by following the path of seeking first and then improving, domestic diaphragms have squeezed into the fields mastered by developed countries, and foreign diaphragms companies generally feel pressure from domestic companies. Gu Chuanming, Deputy General Manager of Cangzhou Mingzhu, once said.

The lithium battery separator industry in China has made great progress. In 2014, China's production accounted for nearly half of the global production, and in 2015, it achieved the domestic replacement of medium and low end separators.

At this stage, the establishment of Shanghai Enjie did not attract attention. Enjie is a transliteration of English energy. At that time, the core business of Enjie founder Li Xiaoming was tobacco film, but in the next stage, Enjie broke out into a huge energy and became the global film king.

four

take off

"The mismatch between the major and profession studied in a university is very common in China. Chen Xiufeng, who is made of Xingyuan material, studied air conditioning while studying at Huazhong University of Science and Technology, but Li Xiaoming of Enjie has a strong professional background.".

After graduating with a master's degree, Li Xiaoming joined the Kunming Plastic Research Institute in 1982, and was promoted to the position of Deputy Director in 1984. Five years later, Li Xiaoming went to the United States to pursue further education, studying polymer materials at the University of Massachusetts. He graduated at the end of 1992, when Chen Xiufeng took classes in the credit and foreign exchange department of a bank in Shenzhen.

After graduation, Li Xiaoming found a job in the United States as the manager of the technology department of Inteplast Corporation, a new company that had just been established for a year. Its main business is film for labeling, which is considered a professional counterpart.

After returning to China in 1996, Li Xiaoming and his younger brother Li Xiaohua and other family members successively founded companies around the material industry, such as Hongta Plastics, Innovation Industry and Trade, Dexin Paper, and Chengdu Hongta. Innovation Industry and Trade was later renamed and restructured into a joint-stock company, Innovation Shares. Li Xiaoming incorporated other companies into Innovation Shares through a series of operations such as equity transfer, capital increase, and share expansion.

In September 2016, when Innovative Shares was listed, its main business did not include lithium battery separators, and Enjie was also located in Shanghai and other places.

In April 2010, Shanghai Enjie was established. As mentioned earlier, the lithium battery separator industry in China is booming at this time. Li Xiaoming said that he had noticed the emerging market of lithium battery separators before, so he made up his mind to quickly enter, but did not quickly capture market share because the wind had not yet come.

The wind is coming, there are two waves.

One wind is an important application field for membrane conversion from digital products to power lithium batteries.

With the rapid development of the new energy automotive industry, the shipment volume of power lithium batteries has rapidly increased from 16.9 GWh in 2015 to 226 GWh in 2021, with a composite growth rate of 54.06%, which has led to an explosive increase in diaphragm shipments. From 2015 to 2021, domestic diaphragm shipments rapidly increased from 630 million square meters to 7.8 billion square meters, with a compound increase rate of 52.2%. Lithium batteries for new energy vehicles have become the largest application field of lithium batteries.

Another wind is the conversion of mainstream membrane products from dry to wet methods.

In 2016, the state adjusted the subsidy policy for new energy vehicles, and the shipment of ternary lithium batteries with higher energy density rapidly increased, driving the shipment of wet separators. From the beginning, Enjie, which had been betting on wet separators, soared. In 2018, the global market share of Enjie Diaphragm reached 14%, surpassing Asahi Kasei of Japan and becoming the new leader in the global diaphragm industry, ranking first in the world in terms of production scale.

In particular, after Li Xiaoming injected Shanghai Enjie into the listed company Innovation Stock (later renamed Enjie Stock), Enjie's position as the global film king has become increasingly stable through continuous construction of new factories, expansion of production, and a series of concurrent mergers and acquisitions, as well as cost advantages brought about by scale effects, to further enhance its competitiveness.

At the same time as ENJE took off, the global lithium battery separator industry has gradually shifted to China, and the share of China's separator manufacturers' shipments has continued to increase. Today, China's separator has accounted for more than 70% of the global market share, making it undoubtedly a large separator country.

Source: official website of Enjie Co., Ltd

In December 2020, the market value of Enjie shares exceeded 100 billion yuan for the first time. Li Xiaoming and his brother specially bought the first cup of milk tea for all Enjie employees in winter.

With a market value of over 100 billion yuan, Enjie has spent four years and three months, from 100 billion yuan to 200 billion yuan, only using more than half a year. In more than two months, the market value has increased by more than 72 billion yuan. Enjie Co., Ltd. is well deserved.

However, the dividends of the times are not evenly distributed, with some taking off and others falling. As mentioned earlier, the membrane industry is a high-risk industry with high barriers to capital and technology. Although the industry development situation is in full swing, there are also many membrane manufacturers in China that are unable to make ends meet, or have been announced to stop production due to poor management, or are unable to compete due to mergers and acquisitions.

All this has not affected the entry of successors. Looking at the booming trend of new energy vehicles in China, the sales volume may further increase. A new wave of diaphragm fever is emerging, and there are many companies entering the diaphragm industry across borders. Regardless of whether newcomers can break the membrane market pattern of "one super many strong", they will inject new strength into China's lithium battery membrane industry.

five

Hidden worries

The diaphragm market is booming and seems strong, but what is the foundation of China's diaphragm? Is there a problem with the industrial chain?

In September of this year, at the Fourth Global New Energy and Smart Vehicle Supply Chain Innovation Conference hosted by the China Electric Vehicle Hundred People Association, Zhuang Zhi, President of Shanghai Enjie Research Institute, raised this question.

As early as 2010, when Miao Wei was worried that we couldn't make diaphragms, he pointed out that the equipment and technology used to produce diaphragms were on the restricted export list of other countries.

Many issues have been well known in the industry since the beginning of the lithium battery separator industry in China. Considering that the important contradiction at that time was to expand the market, ensure the supply of separators, and occupy market share, the bottleneck was not taken seriously. Over the years, the hidden concerns have never been resolved. Enjie has also tried to use domestically made equipment, but unfortunately, it ended in failure. Zhuang Zhi said.

Currently, the manufacturing equipment for dry process diaphragms has been localized. The key is that the core manufacturing equipment for wet process diaphragms relies on imports, with mainstream equipment manufacturers concentrated in Japan, Germany, and France. For example, Enjie's equipment comes from the Japanese Steel Institute.

At the time of a new round of expansion in China's membrane industry, although the head company has been deeply bound with equipment manufacturers, equipment cannot be manufactured by itself, and the production of equipment manufacturers is limited. New ordered equipment often takes 2-3 years to be delivered in batch, and there is still time for commissioning after the equipment is in place, which means that the delivery speed of equipment film cutting plants is constrained.

Diaphragm manufacturers are already thinking of ways. The equipment made of Xingyuan Material is mainly from Germany, not purely purchased, but developed a production line together with the other party, mastering some core technologies. While importing Japanese equipment, Enjie has promoted equipment localization through the acquisition of Suzhou Jieli, Fuqiang Technology, and JOT. Other membrane manufacturers are also stepping up their own research.

More embarrassing than the production equipment situation is the core raw materials. Zhuang Zhi bluntly stated that almost everyone purchases from companies in South Korea, Japan, and the United States.

Membrane matrix materials mainly include polypropylene resin, polyethylene resin, and additives. The quality of raw materials directly affects the performance of the membrane. Like Asahi, Japan, it has an independent polymer laboratory with its own specialized materials.

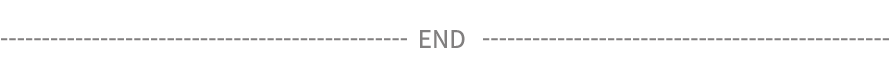

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

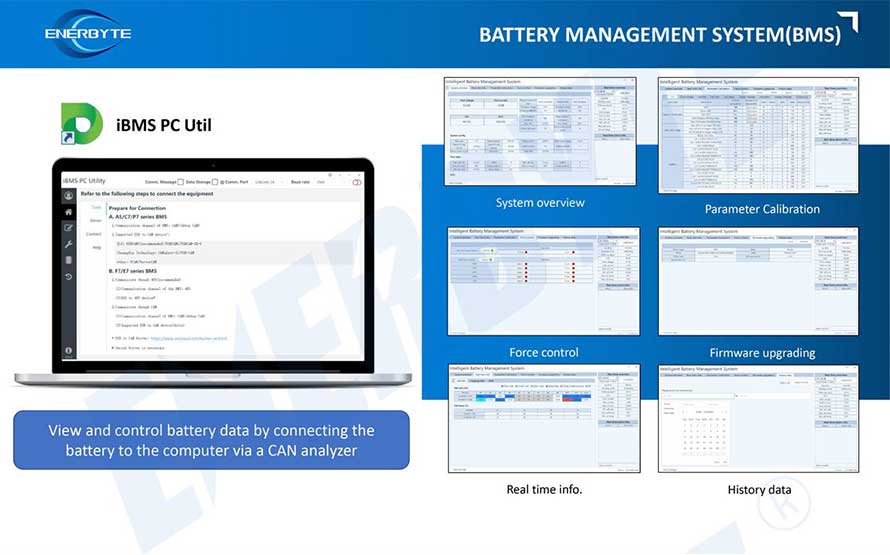

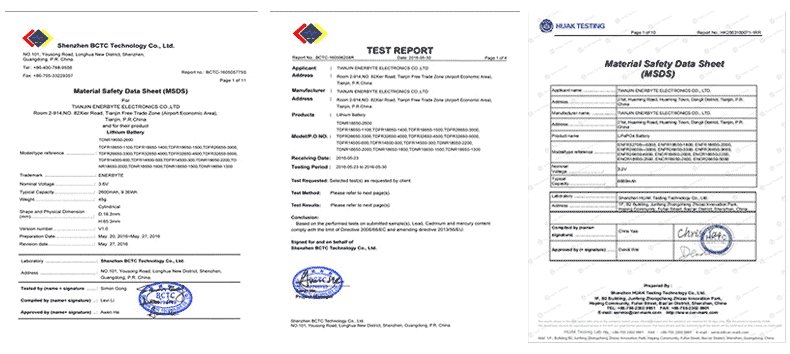

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline