24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

No one wants to be a permanent loser in the game of lithium battery.

At the 12th China Automobile Forum, Zhu Huarong, Chairman of Chang'an Automobile, once again focused on the shortage of chips and the high price of power lithium batteries. It also asserted that the lack of core and expensive electricity have led to the loss of 606000 units of Chang'an Automobile this year.

It is worth noting that when describing the power lithium battery problem, Zhu Huarong uses expensive electricity rather than lack of electricity. In other words, in the current new energy vehicle market, there is no lack of power lithium battery supply, but the power lithium battery supplied by suppliers is too expensive, which makes the new energy vehicle enterprises unbearable.

This is certainly not a battery manufacturer targeting Chang'an. Earlier, Zeng Qinghong, chairman of GAC, publicly bombarded CATL, saying that power lithium batteries accounted for 40%~60% of the total vehicle cost, and mocked GAC for working for CATL.

The repeated grievances of automobile enterprises are enough to prove the seriousness of the problem. Along the power lithium battery supply chain, the first one to find is the power lithium battery company. However, every time this happens, the power lithium battery company will dump the pot to a more upstream raw material supplier.

According to the recent data of Shanghai Steel Union, the price of battery grade lithium carbonate has gone up again, even approaching 600000 yuan/ton. At the beginning of 2021, the price of lithium carbonate was only about 50000 yuan/ton, and has risen nearly 12 times today.

Lithium carbonate, which is naturally futures, has become a major factor in the uncontrolled cost of power lithium batteries. The reason for the high price of power lithium battery is attributed to the vicious speculation of capital. Some sellers are reluctant to sell, buyers are hoarding, and middlemen are hoarding.

So, the peach of the power lithium battery was taken away by the financial industry?

01. Be strong in gambling

From the perspective of business logic, the companies in the power lithium battery industry chain are interest-oriented and justifiable. Moreover, the price of upstream raw materials has become a well-known secret because of the rising demand for new energy vehicles in a short time.

So we all know that one day, the price of upstream raw materials will fall sharply. So before that, since it is profitable, companies will certainly choose to rush forward. Because you bet that you won't be the last person to stand guard.

In fact, around the gambling table, not only the upstream raw material manufacturers are gambling, but also the power lithium battery companies led by CATL, GAC, Weilai and other auto companies are gambling.

First of all, from the perspective of financial statements, except for CATL, all major power lithium battery companies are basically in a state of increasing revenue without increasing profits. This phenomenon was particularly evident at the beginning of this year. And because of the surge of upstream raw materials, battery manufacturers lack the voice and cost control ability of CATL, so they can only eat dumb.

However, other battery manufacturers will certainly be jealous to see CATL make a lot of money. As a result, after the listing of China Innovation Airlines, it quickly launched the European layout; Guoxuan Hi-Tech invested 11.5 billion yuan to establish power lithium battery bases with an annual output of 20GWh and 10GWh in Hefei, Anhui and Liuzhou, Guangxi respectively; Xinwanda won the list of the public; Yiwei Lineng received an olive branch from BMW

On the other hand, the soaring cost of lithium battery will obviously hinder the development of new energy vehicles. Especially for Chang'an and GAC, the price of products sold by themselves is less than 250000 yuan, and the sensitivity of cost is even greater.

By comparison, BYD and TSLA have a much better life, and their common points are also obvious: the control ability of vertical supply chain is extremely strong; It even extended its hand to the mineral resources in the upper reaches.

Since Zhuyu is in front, it will be the right thing to touch TSLA and BYD to cross the river.

Other automobile enterprises have a sample, or actively support the secondary supply, in order to obtain more affordable power lithium battery products; Either he or she went out and built the battery by himself; GAC, Weilai and the Great Wall are all the same.

There is no doubt that in terms of the self-built factories and batteries of automobile enterprises, it will definitely be a loss in a short time. After all, it is far from being able to hydrolyze. However, these car companies are in a rush to gamble on a sustainable future. Similarly, upstream raw material suppliers are also gambling, but they are betting that resources are always short.

When it comes to power lithium battery companies, on the one hand, it is the survival and development of the company, on the other hand, it is the mountain that cannot be removed from CATL. What can we bet on in this case? We can only bet on the favor of individual auto companies and the way to balance the market.

02. Who picked the peach?

New energy vehicles are selling more and more expensive, but in addition to TSLA and BYD, the new forces of car manufacturing led by Wei Xiaoli still claim to be selling cars at a loss. After some understanding, the feedback received was similar, except that the power lithium battery was sold too expensive and the profit was taken away.

Therefore, from the perspective of automobile enterprises, the peach was picked by the power lithium battery company.

According to the latest data of China's power lithium battery industry innovation alliance, in October, the domestic power lithium battery output totaled 62.8 GWh, up 150.1% year-on-year and 6.2% month-on-month. In comparison, the load of power lithium batteries was only 30.5GWh, up 98.1% year on year and 3.5% month on month, less than half of the total output.

What is the reason for this kind of production and less loading? Is it that car companies hoard power lithium batteries for later use after purchasing them? Or do power lithium battery companies have the ability to produce, but car companies have not enough ability to buy?

In retrospect, in 1922, the United States broke out a large-scale economic crisis, the stock market collapsed and the Great Depression. At that time, the dairy industry in the United States was very developed, and the production of milk doubled, resulting in overproduction. In order to ensure profits, farmers poured a large amount of surplus milk into the Mississippi River.

Similarly, is there any reason to believe that in order to ensure sufficient profits, it is not only the upstream raw material suppliers who are hoarding, but also the power lithium battery companies that are artificially manufacturing shortages?

To say the least, it may not be any of the possibilities mentioned above. However, according to the current situation, it is possible to reverse the current situation of uneven distribution of benefits and inappropriate voice in the industry chain in a short time only if the major battery manufacturers work together.

Relevant data show that CATL has had a market share of less than 50% in a single month for seven months, but its position in the power lithium battery industry is still the leading leader in the name. In other words, CATL is the direction sign of China's power lithium battery market. CATL is the object of imitation, regardless of price or development direction.

With regard to the cost of power lithium batteries, Zeng Yuqun, chairman of CATL, once said that the capital speculation of upstream raw materials has brought a short time trouble to the power lithium battery industry chain, and the prices of lithium carbonate, lithium hexafluorophosphate, petroleum coke and other upstream materials of lithium batteries have soared.

So it is worth pondering why CATL can still make a splash of green among the flowers, not only realize the rise of net profit against the trend, but also creatively expand the Japanese market again, and carry out strategic cooperation with Dafa Industry Co., Ltd. (Dafa Automobile) in battery supply and battery technology?

The most direct reason we can see is that even if the price of lithium battery increases, car companies will still buy CATL. When the cost of power lithium battery is transferred smoothly, the gross profit rate of CATL will also stabilize. With the advantages of scale, technology and profitability, CATL can more actively explore other markets.

However, this can only show that CATL relies on its own influence to run the company, and cannot promote the whole power lithium battery industry. As for the profits of other power lithium battery companies, they will still be taken by the more upstream raw material suppliers, and the so-called peach pickers will also move to a higher level.

So who is controlling the price of raw materials? After thinking about it, it may only be those speculation speculators who carry the pot.

As for whether the upstream suppliers are still making money, whether the battery manufacturers really have no pricing power, and whether the car companies have no choice but to accept the high price, they can only wait for the future, depending on the strength of the plan.

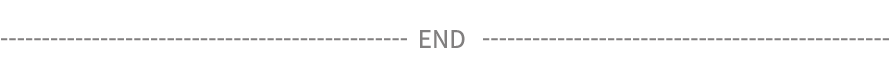

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

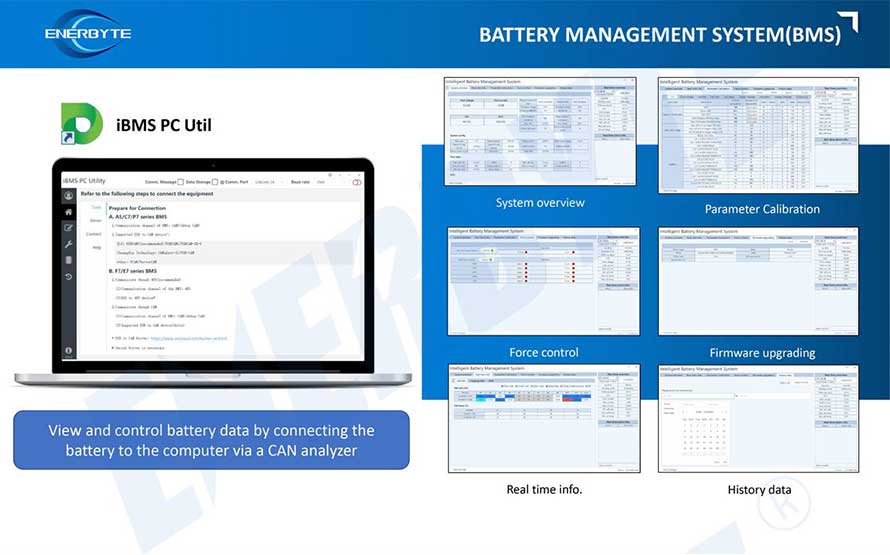

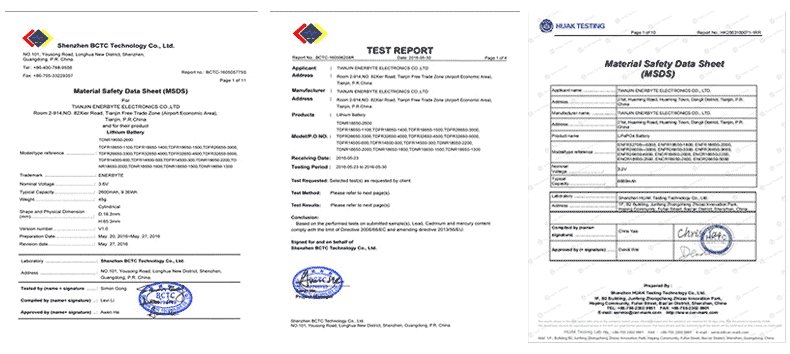

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline