24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Inventory the top ten aluminum-plastic film companies in China based on indicators such as company size, output, industry impact, and product technology, for industry reference.

According to data from the Starting Point Research Institute (SPIR), the installed capacity of soft pack power lithium-ion batteries in China was 7.6 GWh in 2018, a year-on-year increase of 64.2%. If calculated based on 1.5 million square meters of aluminum-plastic film per GWh of soft pack power lithium-ion batteries, the demand for aluminum-plastic film exceeds 114 million square meters. It is expected that by 2020, the demand for aluminum-plastic film in China will reach 220 million square meters, with a market space of 5 billion yuan.

(Source: WeChat official account "Start Lithium TV Big Data" ID: weixin lddsj Author: Liu Miaomiao)

However, due to high production technology barriers, the aluminum-plastic film market has long been monopolized by Japanese and Korean companies such as DNP, Showa Electric, and Kurimura Chemical, with a localization rate of less than 10%. It is currently the only material without large-scale localization.

Under the rapidly expanding market demand, domestic companies are intensifying their research and development efforts. Currently, some companies have broken through technological bottlenecks and achieved product indicators at the level of their Japanese counterparts, leading to large-scale use in the 3C field.

In the field of power lithium-ion batteries, companies represented by Xinlun Technology have made breakthroughs and have entered the supply chain of soft packaging companies such as Funeng, Jiewei, and Weihong. Due to the significant price advantage of domestic aluminum-plastic film, which is about 20% -30% lower than foreign products, with the further reduction of subsidies in 2019, under the pressure of cost reduction, power lithium-ion battery companies may introduce domestic products. In the future, aluminum-plastic film will gradually penetrate from the low-end consumer market to the mid to high end market.

Qidian Lithium's big data takes company size, output, industry impact, product technology, and other indicators to list the top ten aluminum-plastic film companies in China for industry reference.

No.1. Xinlun Technology

Shenzhen Xinlun Technology Co., Ltd. was founded in 2002 and listed on the Shenzhen Stock Exchange in 2010. At present, the company has formed three core industries: electronic functional materials, new energy materials, clean room products, and purification engineering. It has built business clusters such as electronic functional materials, lithium-ion battery soft packaging materials, ultra clean products and cleaning, purification engineering, precision molds, and medical products. We have six major industrial bases in Shenzhen, Suzhou, Changzhou, Tianjin, Shanghai, and Chengdu, with branch offices located in important cities in China, Hong Kong and Taiwan, as well as countries such as the United States, Germany, Japan, and Southeast Asia. We also have over 30 holding subsidiaries.

In August 2016, Xinlun Technology acquired the lithium-ion battery aluminum-plastic film business and factory under Japan's Toppan Printing and Toyo Can Manufacturing. At present, we have two production bases in Changzhou and Mie Factory in Japan. The monthly output of the Japanese base is 3 million square meters, and the first phase of the Changzhou base has a monthly output of 3 million square meters. It was put into operation in September 2018, and the second phase has a monthly output of 3 million square meters. It is expected to start production in March 2019, with a total output of 9 million square meters per month. It is expected that by 2020, the total output will exceed 12 million square meters per month.

At present, the company's important customers include Funeng Technology, ATL, Weihong, Tianjin Jiewei, Shanghai Kanai, CITIC Guoan, Qianjiang Lithium Battery, etc. In 2017, the company also passed product testing by foreign manufacturers such as AESC and LG, and currently has a market share of over 60%.

On January 23rd, Xinlun Composite Materials signed a procurement agreement with Funeng, agreeing to supply 8 million square meters of aluminum-plastic film products to Funeng Technology in 2019.

In 2018, Xinlun Technology's revenue was 3.24 billion yuan, a year-on-year increase of 57.16%, and the net profit attributable to the parent company was 310 million yuan, a year-on-year increase of 82.23%.

No.2. Zijiang New Materials

Established in 2011 by Zijiang Company (Shanghai Stock Code 600210) and New Shanghai International Components, it covers an area of 100000 square meters with a building area of over 18000 square meters. It has a 100000 level clean workshop of over 10000 square meters and internationally leading production lines for composite, coating, and slitting. It is mainly engaged in the research and development, production, and sales of aluminum-plastic films for lithium-ion batteries, and specializes in supplying products and solutions for industries such as lithium-ion batteries.

According to the 2018 semi annual report, Zijiang New Materials' lithium-ion battery aluminum-plastic film business continued to maintain rapid growth, with sales increasing by 78% year-on-year during the reporting period. The company maintains a stable and high-volume advantage in the 3C digital market, while vigorously exploring the power aluminum-plastic film market and adding sales of aluminum-plastic film for electric bicycles.

The company's products cover a full range of products from low-end to high-end. In the 3C digital field, it has already supplied ATL, Guangyu, Lishen and other companies in bulk. In the power field, the products are mainly used in logistics vehicles and electric bicycles. At present, the monthly output has reached 3 million square meters.

No.3. TD Optics

Daoming Optics Co., Ltd. is a national high-tech company specializing in the research, development, production, and sales of various reflective materials and products. It has established provincial-level high-tech research and development centers and provincial-level company technology centers, with more than 30 independent intellectual property rights. The product quality has reached the international leading level. Listed on the Shenzhen Stock Exchange's SME board on November 22, 2011.

The company's aluminum-plastic film adopts dry process technology, which has excellent appearance and cutting performance, stamping formability, corrosion resistance to solution, superior heat sealing strength, and compatibility with polar ear glue. It has entered a stable mass production stage in the second quarter of 2017, and its performance indicators are consistent with similar products of foreign brands. All performance indicators meet or exceed the recognized technical performance requirements in the industry.

From January to September 2018, the company's aluminum-plastic film achieved a sales volume of 2.04 million square meters and a sales revenue of 32.58 million yuan. Especially in the third quarter, the company increased customer expansion, and the monthly total sales volume gradually increased, with some new customers in the power category.

At present, the company has a production capacity of 15 million square meters and has received orders from more than 50 3C lithium-ion battery companies. Mainstream power customers are all in the certification stage, and some small manufacturers and customers of electric bicycles and energy storage vehicles have purchased and used power film. In 2019, the company will increase the sales of aluminum-plastic film for power.

The latest performance report shows that in 2018, Dao Ming Optical's revenue was 1.209 billion yuan, a year-on-year increase of 49.81%, and the net profit attributable to the parent company was 240 million yuan, a year-on-year increase of 93.80%.

No4. Buddha Sculpture Technology

Fosu Technology is a leading company in China's plastic new materials industry, one of the top 500 manufacturing companies in China, a key high-tech company under the National Torch Plan, and a backbone company in Guangdong Province's strategic emerging industries. The company was listed on the Shenzhen Stock Exchange in May 2000 and currently has assets of 5.1 billion yuan. It has 8 subsidiaries and 23 long-term investment companies.

The aluminum-plastic film produced by the company is produced using a thermal process, which has good barrier properties, electrolyte stability, cold stamping formability, puncture resistance, and insulation properties. It can be used in conjunction with various ear products on the market and is widely used in polymer lithium-ion batteries for small electrical appliances such as mobile communications, laptops, MP3 players, handheld DVD players, as well as soft packaging materials for ordinary lithium-ion batteries.

The company's aluminum-plastic film products were developed from 2008 to 2012, and trial production began in 2012 with small batches of shipments. Currently, they are in the market promotion period, mainly focusing on 3C digital battery customers, and their application in the field of power lithium-ion batteries is in the evaluation stage.

No.5. Dongguan Excellence

Dongguan was established in 2011 and is a wholly-owned subsidiary of Putailai. The company is committed to supplying battery packaging materials such as aluminum-plastic film, copper plastic film, and stainless steel plastic film to global mid to high end lithium polymer battery production companies. It is an advanced supplier of lithium-ion battery packaging methods in China.

Dongguan Zhuoyue aluminum-plastic film products adopt independently developed thermal composite and heat treatment processes, successfully solving the problem of adhesion between CPP layer and aluminum foil layer of aluminum-plastic film; We have independently developed a special CPP material for lithium-ion batteries, which solves the problem of ordinary CPP materials being corrosion-resistant and not resistant to high temperatures, and has super strong electrolyte barrier properties; Through industry university research cooperation, an environmentally friendly aluminum foil processing technology has been developed, which improves the insulation performance and electrolyte corrosion resistance of the aluminum foil surface, enhances the edge voltage performance, and reduces production costs; We have independently developed a nylon surface electrolyte resistant coating, which solves the problem of electrolyte corrosion of nylon in the production process of lithium-ion batteries.

At present, the company has 23 invention patents and 9 utility model patents. Important products include 113 μ m aluminum-plastic film, 88 μ m aluminum-plastic film, 115 μ m aluminum-plastic film, 90 μ m aluminum-plastic film, copper plastic film, stainless steel plastic film (used for power lithium-ion batteries), etc. Among them, polymer lithium-ion battery aluminum-plastic film is a domestically produced aluminum-plastic film product with independent intellectual property rights.

In the field of power, Dongguan Zhuoyue has developed steel plastic film products mainly made of stainless steel foil. The product uses ultra-thin stainless steel material as the main packaging material, which improves the punching depth, mechanical strength, and packaging creep of soft packaging batteries for electric vehicles.

Starting from 2012, Xiaoshi Face invested in the construction of a 1 million square meter aluminum-plastic film project in 2015, which mainly covers 3C digital products. In the first half of 2018, the company's aluminum-plastic packaging film business achieved a sales revenue of 25.1 million yuan, an increase of 29.18% year-on-year.

No.6. Mingguan New Materials

Mingguan New Materials is a national high-tech company specializing in the research, development, and manufacturing of advanced new materials in the fields of new energy, building materials, and transportation, as well as new composite film materials such as solar cell backboards, aluminum-plastic films, and special protective materials. The company has over 90 independent intellectual property rights, including invention patents and other patents, and serves clients such as State Power Investment Corporation, China Energy Conservation Corporation, LG, REC, Hanhua, BYD, etc. Last October, Mingguan New Materials submitted its listing materials to the China Securities Regulatory Commission.

The company's aluminum-plastic film project was established in 2010. Currently, Mingguan New Materials has over 30 R&D personnel for aluminum-plastic film and has obtained more than 30 patents for aluminum-plastic film. Since 2016, we have been sending samples for evaluation and have all passed the qualification test. We now have an annual production capacity of 30 million kilometers of aluminum-plastic film for batteries.

Mingguan New Material's aluminum-plastic film products adopt the dry heat composite method, which has the advantage of absorbing the advantages of the dry process while taking into account the process characteristics of the hot method in terms of electrolyte resistance and water resistance. This has comprehensively improved the comprehensive performance of aluminum-plastic film in deep forming, appearance, cutting performance, electrolyte resistance, and water resistance. The company's aluminum-plastic film products have excellent shell forming properties, excellent corrosion resistance, and superior insulation performance.

No.7. Hangzhou Foster

Hangzhou Foster was founded in 2003 and is a high-tech company specializing in the research and development, production, and sales of new materials. The company was successfully listed on the Shanghai Stock Exchange on September 5, 2014. It has 10 subsidiaries in Thailand, Hong Kong, Hangzhou, Jiangsu and other places, engaged in new material research and development production, photovoltaic power plants, international trade, intelligent equipment and other businesses.

We started developing and constructing projects such as aluminum-plastic film in 2015, importing all equipment and raw materials. In 2015, we established a 5 million square meter aluminum-plastic film project, which has achieved mass production and met the performance requirements of battery factories. We have successfully introduced 3C battery customers and become a high-quality supplier of aluminum plastic composite films in China.

In 2018, the company's revenue was 4.81 billion yuan, a year-on-year increase of 4.9%, and the net profit attributable to the parent company was 750 million yuan, a year-on-year increase of 28.38%.

No8. Suzhou Lithium Shield

Suzhou Lithium Shield is a company invested by Huarong Asset Management and Hubei Gaotou in China, registered and established in June 2015.

At present, the company's aluminum-plastic film has formed three major series of nine products, which have excellent deep drawing performance, electrical safety performance, and long-term high barrier and corrosion resistance. They provide high-energy and safe packaging differentiation solutions for automotive power lithium-ion batteries, energy storage batteries, high-end consumer electronics batteries, high rate batteries, polymer batteries, solid-state batteries, etc.

The company has independently developed high-capacity and high-power power lithium-ion battery soft pack aluminum-plastic film and achieved large-scale industrialization. It is the world's first microwave non-polar dry casting aluminum-plastic film manufacturing technology, breaking the dry/hot manufacturing process of Japanese and Korean companies. It adopts physical and chemical anchoring technology to integrate weak polarity and non-polar aluminum-plastic film at multi-layer material interfaces, which is more suitable for high rate and strong polarity application environments of power lithium-ion batteries, ensuring the long-term safety life of batteries and filling the gap in domestic aluminum-plastic film research and development technology.

The company's products are mainly used in 3C digital products, and have already been shipped in small batches and patented. In the next two years, it will invest 100 million yuan to build a 20 million square meter aluminum-plastic film production and research and development center for power lithium-ion batteries, with an annual output value of 600 million yuan.

No9. Suda Huicheng

Sudahuicheng was founded in 2008 and is an innovative company dedicated to the research and production of composite materials for lithium-ion batteries. The company has multiple (sets) aluminum-plastic film production lines, and has integrated elite domestic and foreign R&D teams to establish a product R&D center. It has developed and produced aluminum-plastic composite films for lithium-ion batteries, and currently holds more than 50 patents.

At present, it has an annual production capacity of 25 million square meters and has two major product systems: digital and power. In 2018, the monthly sales of 3C digital aluminum-plastic film reached 1 million square meters, and the monthly sales of aluminum-plastic film for power lithium-ion batteries were 500000 square meters.

No10. Andeli

Guangdong Andeli New Materials Co., Ltd. was established in 2002 and is a private technology and high-tech company in Guangdong Province specializing in the production of environmentally friendly functional films. The company has a total of 5 sets of advanced domestic and imported functional composite film production equipment, and 1 set of advanced lithium-ion battery soft pack aluminum-plastic composite film imported production equipment.

The core equipment of Andeli is imported from Japan, and the products have excellent heat sealing and resistance to electrolyte erosion, meeting the market's performance requirements for aluminum-plastic films used in lithium-ion batteries. The design output of the company's aluminum-plastic film is 30 million square meters per year. Currently, the production of aluminum-plastic film for batteries is about 100000 square meters per month, and the shipment volume is about 30000 to 50000 square meters per month,

In July 2017, the company developed aluminum-plastic film for power lithium-ion batteries and sent samples to downstream manufacturers for testing. Among them, the corrosion resistance of the 152 type aluminum-plastic film for power was fully qualified, reaching the level of imports. At present, the company's second-generation 152 power aluminum-plastic film is being tested by downstream manufacturers and is expected to be supplied in small quantities soon.

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

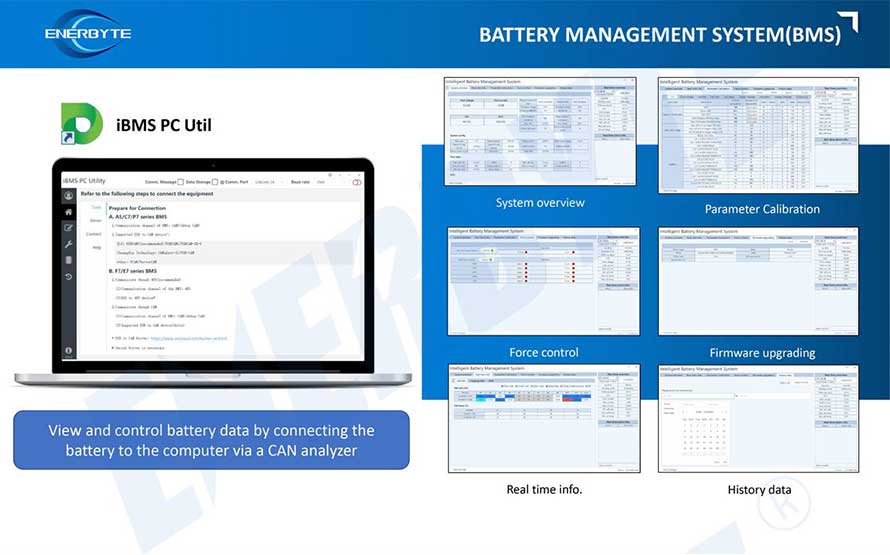

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline