24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

Last month, Guo Shougang, deputy director of the First Equipment Industry Division of the Ministry of Industry and Information Technology of the People's Republic of China, said when participating in an industry event that "lithium resources are still at a high level."

Since the Ministry of Industry and Information Technology of the People's Republic of China (MIIT), together with many departments, proposed to "rectify" the price rise of lithium materials in March this year, lithium carbonate and other prices have temporarily stopped the momentum of soaring, and there was a certain correction in April, but soon "stopped falling".

It is reported that on July 11, the person in charge of a company with an annual output of ten thousand tons of lithium carbonate in Qinghai said that the latest ex factory price of battery grade lithium carbonate was about 480000 yuan/ton, "the sales order was full, and the inventory was less than 300 tons. The lithium carbonate market became active again, and the situation of lithium carbonate in short supply has not been improved."

The rapid growth of new energy vehicles and energy storage industry has driven the market's demand for power lithium batteries and energy storage batteries. As the key raw material of lithium batteries, the "fight" for lithium resources continues.

Acquisition of 100% stake in Argentina Lithea

Ganfeng Lithium aims to supply 70% of its own lithium mines by 2025

On July 11, Ganfeng Lithium, a lithium giant, announced that in order to further strengthen the distribution of lithium resources in the upstream, improve the self-sufficiency rate of the company's resources and enhance the company's core competitiveness, the company agreed that its wholly-owned subsidiary Ganfeng International Co., Ltd. or its wholly-owned subsidiary would purchase no more than 100% of the shares of Lithea Inc., and the total consideration for this acquisition would not exceed 962 million dollars (about 6.4 billion yuan).

According to the data, Lithea is mainly engaged in the acquisition, exploration and development of lithium mining rights. Its important asset PPG project is the lithium salt lake project located in Salta Province, Argentina, including two lithium salt lake assets, Pozuelos and PastosGrandes.

Ganfeng Lithium has previously invested in Mariana, Cauchari Olaroz and other salt lake resources in Argentina.

However, Lithea has not actually operated, so there is no sales revenue. As of April 30, 2022, the total assets are only $49.52 million. It can be seen that the purchase price of Ganfeng Lithium is much higher.

Ganfeng Lithium said that the PPG project of Lithea Company planned to produce 30000 tons of lithium carbonate annually in the first phase, and could be expanded to 50000 tons of lithium carbonate annually depending on the natural resource conditions of the project location.

According to battery information in China, as of December 2021, Ganfeng Lithium has a battery grade lithium carbonate output of 43000 tons/year and a battery grade lithium hydroxide output of 81000 tons/year.

Based on the judgment on the good development prospects of power and energy storage battery markets, Ganfeng Lithium believes that by 2025, the global market will have a demand scale of more than 1.5 million tons of lithium carbonate equivalent, and the company's goal is to form a supply capacity of no less than 300,000 tons of lithium carbonate equivalent by 2025, so as to meet the booming demand of the lithium market.

At the same time, in order to ensure profits, Ganfeng Lithium is also actively increasing its proportion of self supply of lithium resources. "From the perspective of long-term development, the company insists on further increasing the supply proportion of its own resources." Ganfeng Lithium said that, with the continuous production of the resource projects held by the company, it is expected that the supply proportion of the company's own resources will reach about 70% in the future, that is, by 2025, among its production scale of 300000 tons of lithium carbonate equivalent, about 200000 tons of product raw materials of lithium carbonate equivalent will come from the supply of its own resources.

It is reported that in terms of overseas lithium resource layout, Ganfeng Lithium has been deployed in Australia, Argentina, Mexico, Mali, Ireland and other countries; In terms of domestic resources, the company has distributed lepidolite ore in Jiangxi, Inner Mongolia and other regions, and salt lake resources in Qinghai and other regions. In addition, the company is also strengthening the recycling capacity of waste power lithium batteries, and constantly increasing the proportion of its own resource supply.

This time, it invested 962 million dollars to acquire Lithea, on the one hand, to meet its goal of 70% self financing of lithium resources by 2025; On the other hand, it is also to compete for the few high-quality lithium resources in the world.

The "lithium war" continues

Battery companies have entered the market

By the end of June 2022, the number of new energy vehicles in China has exceeded 10 million. In addition, the latest data shows that from January to June this year, the sales volume of new energy vehicles in China reached 2.6 million, up 115.0% year on year, and the penetration rate of new energy vehicles has reached 21.56%.

The new energy vehicle industry is developing rapidly. At the same time, under the "dual carbon" strategic goal, the energy storage industry is also ushering in a big explosion. At present, the global leading battery company plans to produce more than 3500GWh of lithium batteries by 2025, and the demand for upstream lithium carbonate will also remain high.

On the one hand, in order to ensure the supply security of lithium salts such as lithium carbonate, the built output can be effectively released; On the other hand, the high price of lithium carbonate also affects the profits and competitiveness of battery companies. In order to achieve supply security and improve cost competitiveness, head battery companies have entered the field of lithium resources.

Argentina is the country with the largest proven lithium resource reserves in the world, and has a huge amount of salt lake resources. In addition to Ganfeng Lithium, Guoxuan High Tech, a domestic battery company, has also been located here.

On June 24, Guoxuan High Tech (USA) Co., Ltd. and JEMSE signed a cooperation agreement in Argentina. The two sides decided to establish Guoxuan Huhuyi Mining Co., Ltd. jointly, plan and build battery grade lithium carbonate production line, and further promote the implementation of the company's supply chain globalization strategy.

The two parties agreed to establish a joint venture, establish and operate a battery grade lithium carbonate refinery in Perrico Free Trade Zone, Huhui Province, carry out research and development and production of lithium carbonate and other related products, plan to build a battery grade lithium carbonate production line with an annual output of 10000 tons in the early stage, and plan to build a battery grade lithium carbonate production line with an annual output of 50000 tons in the later stage according to market demand.

Prior to this, in May this year, Yichun Guoxuan Mining, a subsidiary of Guoxuan Hi Tech Holding, just successfully won the prospecting right for porcelain clay (lithium containing) ore in Shuinan ore section of Keshili mining area in Yifeng County, Jiangxi Province with a quotation of 460 million yuan. This is the second exploration right obtained by Guoxuan High Tech in Jiangxi.

"Li Rushing" is actually a scene of Toutou Battery Company this year.

On June 1, a source said that BYD had successfully bought six lithium mines in Africa, of which the ore quantity with a lithium oxide grade of 2.5% was expected to reach more than 25 million tons, equivalent to about 1 million tons of lithium carbonate equivalent.

It is estimated that if all the 25 million tons of lithium ore were mined, it could meet the demand for lithium products for 27.78 million 60 kilowatt hour pure electric vehicle power lithium batteries. This may mean that BYD should not worry about lithium shortage in the next decade or so.

It is worth noting that in March this year, BYD also invested 3 billion yuan to acquire more than 5% of Shengxin Lithium Energy as a strategic investor. Shengxin Lithium Energy's main business covers lithium mining and dressing, lithium salt and metallic lithium, etc. The company's lithium product sales last year exceeded 42000 tons.

In addition, battery and material companies including CATL, Yiwei Lithium Energy, Honeycomb Energy, Xinwangda, German Nanometer, etc. have distributed lithium resources to the upstream through acquisition, equity participation, joint venture and other ways to ensure stable supply of raw materials to form a cost advantage.

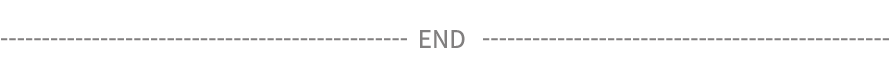

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

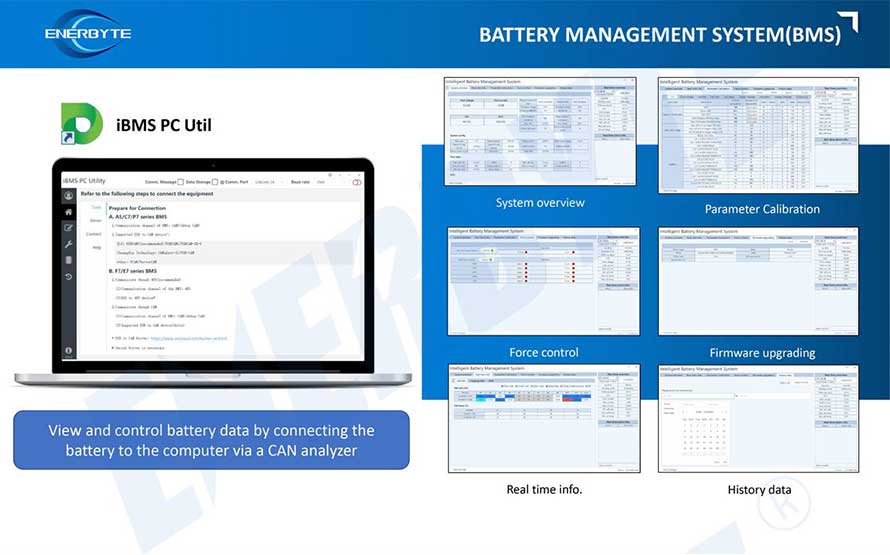

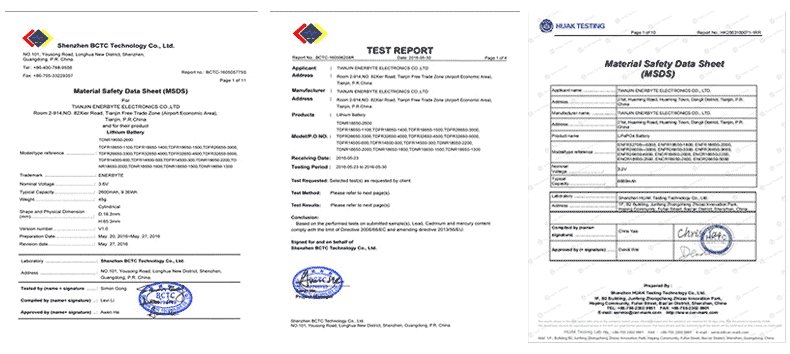

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline