24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , Pallet Trucks LiFePO4 Battery, LiFePO4 Pallet Trucks Battery, Lithium Pallet Trucks Battery,

This year's "golden nine and silver ten" still failed to boost the continuously depressed automobile market, and China's automobile market entered a cyclical trough. However, the production and sales of new energy vehicles have been rising against the trend.

According to the latest data released by the China Association of Automobile Manufacturers, the production and sales of new energy vehicles were 735000 and 721000 respectively from January to September, an increase of 73% and 81.1% over the same period last year. At a time when the production and sales of fuel vehicles declined significantly year on year, new energy vehicles grew at a high speed year on year.

At the same time, as the performance of new energy vehicle enterprises in the third quarter of 2018 has been released in succession, "general increase in sales and general decline in profits" is becoming a typical feature of the entire industry chain of new energy vehicles.

From the statistics of the third quarter results and forecasts of 46 new energy automobile industry chain companies, the chain reaction caused by the decline of subsidies was further revealed. Of the 46 enterprises, about half of the 22 enterprises are expected to reduce their net profits. On the whole, in addition to the overall bullish performance of upstream battery material companies, the middle and downstream power batteries are polarized, and the vehicle market performance is generally sluggish.

Among the 18 complete vehicle enterprises with a large number of new energy vehicles in their business structure, the net profits of 12 enterprises decreased year on year, especially the performance of commercial vehicle and bus enterprises. In the field of commercial vehicles and passenger cars, the decline of Ankai Automobile is amazing.

According to its performance report released on October 25, from January to September, Ankai Bus had a net profit loss attributable to shareholders of the listed company of 258 million yuan, down 207.89 percentage points year on year.

In addition, as the leader of new energy vehicles, BYD also released a report on October 29 that its net profit attributable to shareholders of listed companies in the first three quarters was 1.527 billion yuan, a year-on-year decrease of 45.30%. "The performance in the first three quarters declined, mainly due to the new energy subsidy adjustment policy.

It is expected that in the fourth quarter, BYD's new energy vehicle business will continue to maintain strong growth and drive the rapid recovery of the group's profits. " BYD said in the performance announcement.

On the one hand, the penetration rate of new energy vehicles in September has reached 5%, which is expected to relay SUVs and enter the third round of growth cycle of the car market.

On the other hand, the profit crisis of new energy vehicle enterprises that "subsidized for profit" gradually emerged in the third quarter.

Zhang Junyi, partner of Weilai Capital, predicted that the situation would be relatively better in the fourth quarter. "In the fourth quarter of 2018, the growth rate of the new energy vehicle market, especially the passenger car market, will slow down and show a trend of differentiation, which depends on the structured demand. In view of the previous rapid rise, the car market needs to enter a recovery period, and finally form a diversified market body." Zhang Junyi told reporters.

Whole vehicle enterprises declined under the influence of subsidies

The rare "three consecutive falls" from July to September made many car enterprises feel "pressure mountain". On the other hand, although the sales of new energy vehicles are booming, the profits have declined to varying degrees. The embarrassing market of "new cars sell well, but don't make money" continued in the third quarter.

The latest data from the China Association of Automobile Manufacturers shows that in September, the production and sales of new energy vehicles were 127000 and 121200, respectively, up 64.43% and 54.79% year on year. From January to September, 734600 and 721500 new energy vehicles were produced and sold, up 73.05% and 81.05% over the same period of the previous year.

Among them, the production and sales of pure electric vehicles reached 554600 and 540500 respectively, up 58.94% and 66.19% over the same period of the previous year; The production and sales of plug-in hybrid vehicles reached 179900 and 180800 respectively, an increase of 138.04% and 146.87% over the same period last year.

While the production and sales increased, the corporate profits did not match. In the third quarter report of 18 major new energy automobile enterprises according to wind statistics, except for GAC Group, Dongfeng Motor, FAW sedan and BAIC Bluevale, the sales profit of four automobile enterprises increased positively, the profit of other enterprises declined to varying degrees.

In terms of passenger cars, the biggest drop was in JAC. On October 30, JAC Motor released its report for the third quarter of 2018, which showed that the company's total operating revenue in the first three quarters was 36.331 billion yuan, an increase of 2.22% over the same period last year; The net profit attributable to the shareholders of the listed company was 47.8273 million yuan, down 78.13% from 219 million yuan in the same period last year.

According to the third quarter performance pre reduction announcement released on October 19, JAC's performance decline was mainly affected by the new energy vehicle policy and product structure.

At the same time, the performance of Jiangling Automobile and Zhongtai Automobile is not very optimistic. On October 25, Jiangling Motor released its third quarter performance report, and the net profit attributable to shareholders of the listed company was 219 million yuan, a decrease of 66% over the same period last year.

In this regard, Jiangling Automobile said that the main reasons for the performance changes were the decline in sales volume and the deterioration of sales structure, as well as the intensive investment in new products and technologies, although some of them were offset by the decline in costs. The performance of Zotye Automobile deteriorated significantly in the third quarter, with its revenue and profit nearly halved.

According to the third quarter report of Zhongtai Automobile in 2018, the company achieved a revenue of 3.114 billion yuan from July to September, a year-on-year decline of 46.38%; The net profit attributable to shareholders of the listed company was 110 million yuan, down 57.08% year on year.

In the commercial vehicle and bus market, the profit reduction is still continuing. Except for Yaxing Bus and Shuguang Shares, the performance of Ankai Automobile, Yutong Bus, Zhongtong Bus and Jinlong Automobile in the third quarter fell to varying degrees.

On October 29, Yutong Bus, the leader of new energy buses, fell rapidly after the opening and closed at 11.07 yuan per share.

The day before the drop limit, Yutong Bus disclosed its third quarter report. In the first three quarters of 2018, it achieved operating revenue of 19.374 billion yuan, up 2% year on year; The net profit attributable to shareholders of the listed company was 1.198 billion yuan, down 37.04% year on year. In 2018, Yutong Bus has been in a downward trend. In the first quarter of this year, the net profit attributable to shareholders of the listed company was 295 million yuan, down 6.81% year on year, and the profit in the second quarter was down 34%.

Yutong Bus is plagued by product backlog caused by market fatigue. According to the third quarter report of the Company, during the reporting period, the inventory of the Company exceeded 4.6 billion yuan, with a year-on-year growth of 49.88%, mainly due to the impact of the increase in stock in the high production period and the investment in staff housing. At the same time, the short-term borrowings of Yutong Bus also increased significantly by more than 4.3 billion yuan, a year-on-year increase of 461.26%.

According to the third quarter report of 2018 released by Zhongtong Bus on October 31, the net profit attributable to the parent company in the first three quarters is expected to be 33.69 million yuan, a year-on-year decrease of 72.4%. Zhongtong Bus once again attributed the decline of performance to subsidy factors. The report said that the company's financing expenses increased due to the lack of national new energy bus promotion subsidy funds, which led to a sharp year-on-year decline in the company's operating performance in the first three quarters of 2018.

From the above financial reports and market performance, the subsequent impact of the subsidy recession on the new energy passenger vehicle and commercial vehicle market is gradually emerging. The profit space of major engine manufacturers has been continuously compressed, and even the leading companies have fallen into the dilemma of "increasing income without increasing profits".

The upstream industrial chain is in the "golden age"

While the overall performance of the new energy vehicle market has declined, the upstream enterprises at the end of the industrial chain raw materials have received a lot of good news.

According to statistics, most of the 20 enterprises in the lithium battery industry chain, such as Ningde Times, Guoxuan Hi Tech, Yinghe Technology and Xingyuan Materials, have achieved both revenue and profit growth, and the entire lithium battery industry chain has shown an overall positive trend;

However, there are also a few enterprises with negative year-on-year growth in net profit, or even loss. The net profit of Kinrui Voneng dropped by 490%. After excluding the impact of the disposal of subsidiaries last year, Ningde Times, a leading battery enterprise, saw its revenue and profit increase.

On October 30, Shanshan Co., Ltd., a leading enterprise of lithium battery positive and negative electrode materials, released its third quarter report. The report shows that the operating revenue of the company in the first three quarters was 6.382 billion yuan, a slight decrease of 3.94% year on year, and the net profit attributable to the parent company was 1.054 billion yuan, an increase of 125.27% year on year, doubling the performance.

The third quarter report of Beiteri, a leading enterprise of cathode materials, also showed that Beiteri had a revenue of 1.010 billion yuan during the reporting period, up 16.79% year on year; The net profit attributable to the shareholders of the listed company was 154 million yuan, up 45.71% year on year.

In addition to the steady growth of positive and negative electrode material leading enterprises, the performance of Tianci Materials, New Zebang and Jiangsu Guotai, the main three listed electrolyte companies, also continued to be positive. On October 30, the third quarter report was released.

The announcement shows that the company's operating income in the first three quarters was 1.5 billion yuan, a year-on-year decrease of 2.39%, and the net profit attributable to shareholders of the listed company was 470 million yuan, a year-on-year increase of 70.08%. The third quarter report of Jiangsu Guotai also showed that the net profit attributable to shareholders of the listed company was 303 million yuan, up 32.62% over the same period last year.

The other electrolyte is the core enterprise New Zebang, whose operating income in the first three quarters was 1.55 billion yuan, up 21.71% year on year; The net profit attributable to shareholders of the listed company was 208 million yuan, up 2.11% year on year. However, the net profits of Xiamen Tungsten, CITIC Guoan and China Baoan, the main cathode materials, all showed a downward trend.

The net profit of Xiamen Tungsten Industry was 449 million yuan, down 23.42% year on year; The net profit of CITIC Guoan was 5.82 million yuan, down 17.04% year on year; China Bao'an's net profit was 98.61 million yuan, down 45.36% year on year.

In view of the reason why the income increase does not increase profits, Xiamen Tungsten Industry said that the profitability of the company's tungsten molybdenum and lithium battery material business decreased year on year due to the rise in the price of raw materials, the impact of the relatively low price of rare earth products, etc. Citic Guoan pointed out that the main reason was that the subsidiary reduced the impact of investment income from the transfer of equity of Tianjin Mengguoli Company.

"The downstream industry of new energy vehicles has been impacted, and the upstream material manufacturers are certainly not happy. However, for medium and high-end enterprises, the phenomenon of supply exceeding demand still exists, which is why some battery material enterprises continue to expand capacity, but will be more cautious than before." Zhang Junyi said.

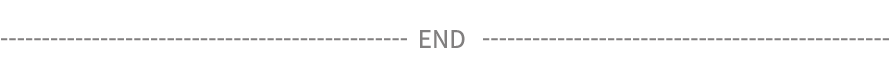

Lithium Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

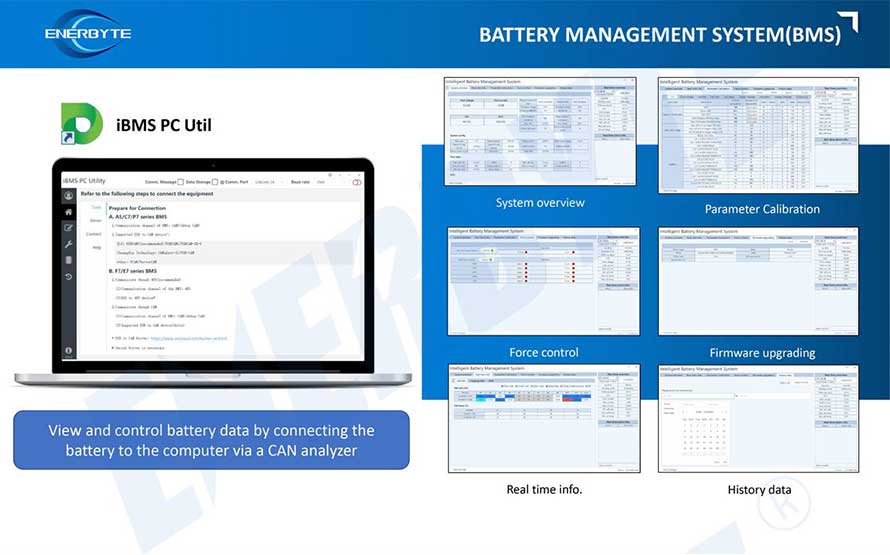

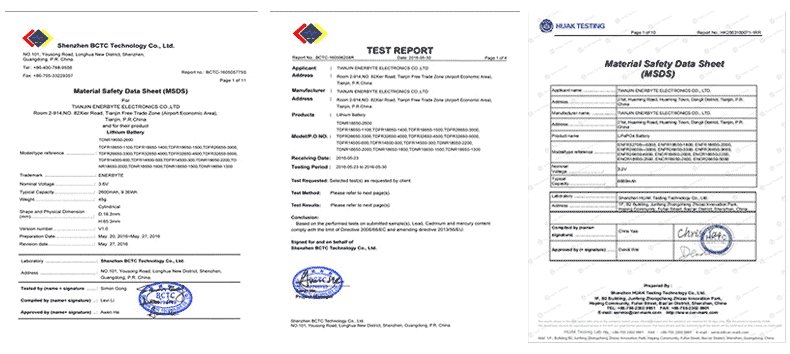

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

Service hotline

Service hotline